Are you wondering how the Affordable Care Act (ACA) affects your income taxes? Can an ACA plan translate into more money back?

The ACA and the Premium Tax Credit

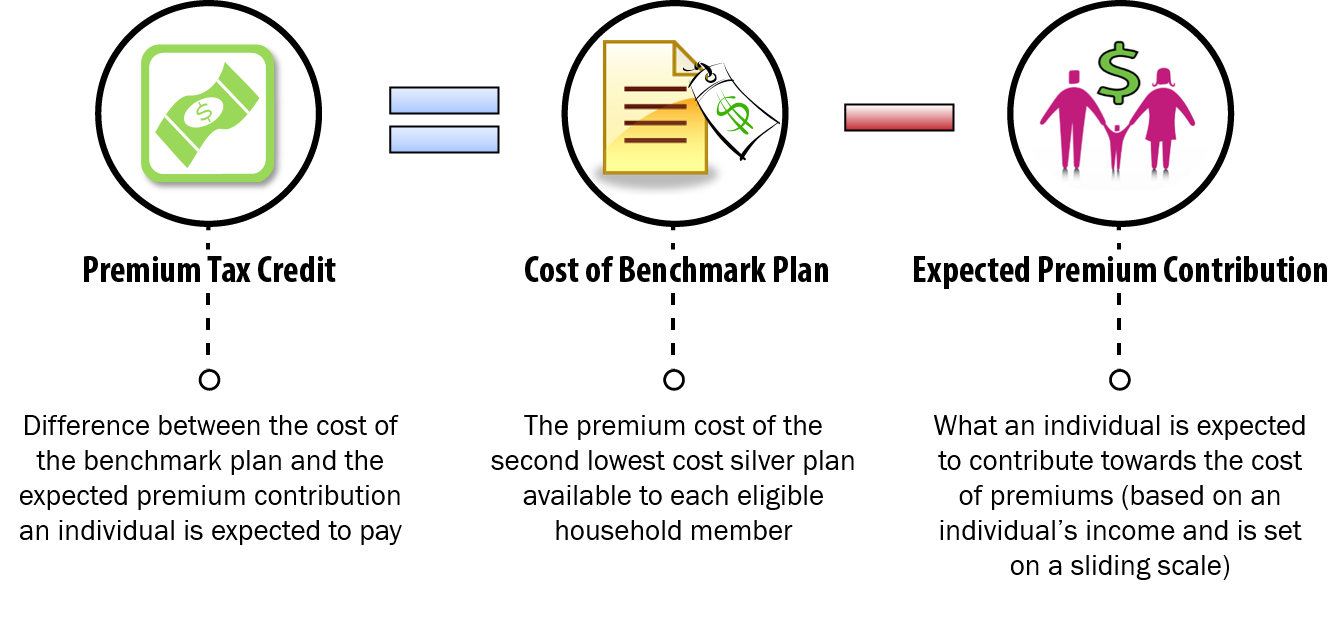

If you have an Affordable Care Act (ACA) plan through the health Insurance Marketplace, then you may qualify for what’s known as a Premium Tax Credit. The premium tax credit was established by the Affordable Care Act. It makes health insurance premiums for coverage purchased through the Health Insurance Marketplace more affordable for eligible individuals. The Premium Tax Credit is the main way that having an ACA plan impacts your taxes.

How to Qualify For a Premium Tax Credit

Whether you apply for Marketplace Insurance through HealthCare.gov or an official partner like HealthSherpa, you’ll find out if you might be eligible for a premium tax credit. You can qualify fora Premium Tax Credit whether you enroll during Open Enrollment or during a Special Enrollment Period. You can use your income to estimate whether you will qualify for the Premium Tax Credit and how much that credit might be.

How to Use Your Premium Tax Credit

Qualify for a Premium Tax Credit? You can use this tax credit to reduce the amount you pay in premiums for your ACA plan. The Premium Tax Credit is applied against each month’s individual premium. You can elect to use all or some of it against your monthly premiums.

Want to use your Premium Tax Credit? The the Marketplace will go ahead and issue your tax credit directly to your insurance company each month. This way, you don’t have to worry about anything on your end when it comes to receiving your discounted rate. Elect to use your premium tax credit to reduce your monthly premium amount? Then this is an “advance payment of the premium tax credit.”

Use it to reduce the amount you pay in premiums for your ACA plan.

Do people have to take the premium tax credit in advance?

No. Most people want to get the credit in advance because they can’t pay their entire monthly health insurance premiums without help, but if they choose, people can wait and receive the credit when they file their taxes.

People can also take a lower advance payment than the amount that is calculated based on their estimated income for the year and receive any remaining credit they are due at tax time.

What To Do If Your Income Changes

If your income goes up or down in a given calendar year, this will impact your Premium Tax Credit amount. If you are aware of any significant changes to your income in real time, report them to the Marketplace. This way, you can adjust your premium tax credit amount. This will ensure you don’t OWE for your ACA Healthcare Plan on your taxes. When you prepare you annual income tax return, you will reconcile your premium tax credits against your income.

Using your 1095-A form, you will see if, based on your actual end-of-year household income for that tax year, you may need to pay back any of the money you received in tax credit for your Marketplace insurance in your taxes. You might also find that you receive additional money back on your taxes in the form of a tax refund after you reconcile your 1095-A form for the year. This is why it is essential that you have form 1095-A on hand before you begin preparing your taxes if you are insured through the Marketplace.

Can people who don’t have to pay federal income taxes take advantage of the premium tax credit?

Yes. The premium tax credit is refundable, so people whose income taxes are lower than their premium tax credit can still take advantage of the credit. People eligible for the credit will be entitled to the full credit amount whether they take it in advance or wait until they file their taxes. For example:

- With an annual income of $24,280 for 2019, John is eligible for a premium tax credit of $3,412 for the year. John enrolls in a silver plan. In February 2020, when John files his 2019 tax return, John’s federal tax is $1,500. He will receive the full premium tax credit amount of $3,412 even though the amount of the credit is larger than his federal income tax liability.

For more information regarding the Premium Tax Credit and if you qualify, or if you would like to be quoted for Health Insurance, please give us a call! (623) 889-7600!