A millennial asks what is an HSA and how does it work? An HSA is the acronym for Health Savings Account. An HSA is a tax-exempt savings account used in conjunction with a High Deductible Health Plan or HDHP, to pay for qualifying medical expenses, but also has other functional benefits, like tax advantages and investment options.

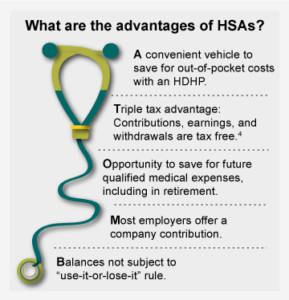

Individuals who have a qualifying High Deductible Health Plan can implement a Health Savings Account (HSA) to pay for qualifying medical expenses. Both employees and employers are able to make contributions to an HSA. An HSA can be a great idea and a good deal, especially for someone just starting out. The combination of tax advantages and a long-term field of vision is ideal for making the most out of this specific benefit, not only to handle potential medical expenses but also to help build long-term financial security. One benefit of an HSA is that monthly Health Insurance Premiums are comparatively low. For a younger individual, like a millennial, that’s a great deal, but to add to that, and similar to an IRA, an HSA lets you make annual contributions and offers significant tax perks, which is where the deal really sweetens.

HSA Accounts Have a Triple Tax Advantage

- Firstly, contributions to an HSA are federally tax-deductible, reducing your taxable income.

- Secondly, both contributions are earnings or gains grow federal tax-free.

- Thirdly, withdrawals for qualified out-of-pocket medical expenses are also tax-free – whenever you take them, no matter your age, which is great! Those expenses can include deductibles, copayments, prescriptions, and necessary medical equipment as well as any medical care not covered by insurance, such as vision, dental, hearing and long-term care. You can also use it to pay for medical expenses for a spouse or other dependent.

It’s a different story, however, if you take the money for something other than a qualified medical expense. In that case, you would pay ordinary income taxes on the withdrawal and a penalty if you’re under the age of 65. After 65 you can use an HSA to cover any expense, withdrawals would just be subject to ordinary income tax, but not implement a penalty. If you follow the rules, the tax advantages can be significant.

An HSA Rolls Over – Year After Year

One particularly exciting aspect of an HSA account is that if you don’t use it, you DO NOT lose it, unlike a Flexible Savings Account (FSA). The money is yours whether you need to use it right away or a number of years down the road. There’s no pressure to spend for the sake of spending, because you won’t lose the money. If you don’t use it, just let that money grow tax-free. Even more, is that an HSA is portable, meaning if you change employers you can take it with you.

Regardless of Your Income, You’re Eligible

Unlike deductible IRAs or Roth IRAs, there is no income limit in order to start or contribute to an HSA. That means that higher wage earners can take advantage of a 100% federally tax-deductible account, unlike other deductions that they may be phased out of due to income limitations. In this way, and HSA can act as a supplemental IRA. Employers must offer an HSA qualified insurance plan usually an HDHP, for an employee to be eligible for an HSA. Individuals may also purchase an HSA qualified insurance plan through the individual insurance market.

Put it to Work for Your Future

An HSA can also be an investment account, not just a savings account. So, if you’re fortunate enough that you don’t need to use the money to cover ongoing medical costs, you may be able to invest the balance in mutual funds, stocks, or fixed income (depending on what the plan offers, and generally once a minimum account balance is reached). Time is of course a key factor in being able to take full advantage of the investment growth potential of an HSA. As a millennial, time is one of your greatest assets. If you put it to work for you now, your HSA could be a supplement to your retirement accounts or even a retirement account just for healthcare when you reach those golden, yet costly, years.

You Have to Fund It

Of course, there’s a catch, but not an unexpected one. All of these benefits only work if you actually fund your HSA, meaning that you make annual contributions, ideally up to the max allowed. For example, for 2019, contribution limits are $3,500 for an individual, and $7,000 for a family. Plus, there’s an extra $1,000 catch-up contribution for those 55 and older.

If your employer offers an HSA as a benefit, you may be able to have your contributions automatically deducted from your payroll check. If you’re lucky, your employer may also offer contributions. If you are on your own in making contributions, you may be able to set up a monthly deduction from your bank, or simply write a check to the HSA account, but however you make the payments, make them consistently. You don’t have to contribute the max, but if you can that can be a great way to grow your money.

One example that might convince you or give you a good perspective on the benefits of growing your HSA account. Let’s say you contribute the individual maximum of $3,500 a year, for 35 years. That may sound like a lot, but it’s actually about $292 per month pre-tax deduction. Let’s also say that you withdraw an average of $1,000 a year in medical expenses. If you earned and annual of 5% on the balance of your HSA, you’d end up with $250,000 after 35 years of consistent max contribution. Now that’s a great deal!

Do Your Homework

The pluses generally outweigh the minuses for most people. But make sure you do your homework to make sure an HSA is the right decision for you. Get the details on your High Deductible Health Plan (HDHP). While premiums may be lower, there may be medical network requirements or restrictions. While the upfront tax advantage of an HSA is great, an HDHP means you’ll have a higher deductible to cover. That could mean higher out-of-pocket healthcare expenses until you meet your deductible. To help that balance out, most HDHPs provide preventative services like routine checkups, prenatal and well-child care, immunizations, and certain screening services before having to meet the annual deductible, but the idea is that reduced premiums plus HSA tax advantages will compensate.

You’ll also have to check for any potential fees associated with your HSA plan. There might be a monthly maintenance fee as well as costs related to checks or debit cards. Be aware of investing costs if you invest your HSA in mutual funds or other securities like stocks. Get the details from your employer or the financial institution providing the HSA.

In summary, you can see how an HSA plan can be extremely beneficial, especially the earlier you start it, and for younger people like millennials who may not need to use as much towards ongoing medical care, it is a great opportunity to grow your account for funds you can use when you need to or save it for the future as a supplemental retirement account.