What is COBRA and How Do You Get it?

COBRA stands for the Consolidated Omnibus Budget Reconciliation Act, and it is a Health Insurance Program that allows an eligible employee and his or her dependents the continued benefits of Health Insurance coverage in the case that an employee loses his or her job or experiences a reduction of work hours. Cobra requires that continuation health coverage be offered to workers and their families when it would otherwise be lost due to a change in employment status.

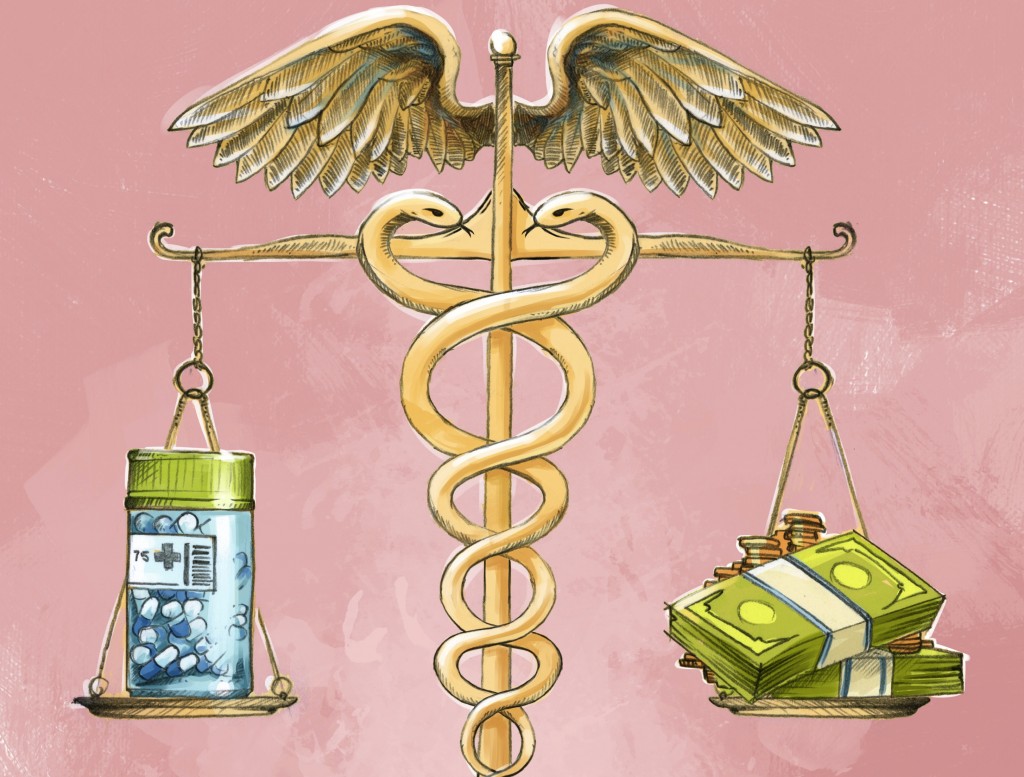

COBRA Insurance is extremely helpful for people in between jobs, experiencing loss of hours, or are in early retirement, as it allows them to take advantage of group insurance rates for up to 36 months. However, the individual is often times responsible for both the employer’s and employee’s portions of the monthly premium under COBRA, which can drive up costs.

More than 158 million Americans get health insurance through their employer. If you unexpectedly lose your job, or retire early, you may get to hang on to that benefit through COBRA Insurance. COBRA allows a person to continue receiving the exact same health coverage they’ve been getting from their employer after they leave the company, as long as they’re not under coverage by another plan elsewhere.

Who Qualifies for COBRA?

Any person who was enrolled in Health Coverage through their employer is eligible for COBRA insurance if there has been a “qualifying event”, meaning they were either terminated from their position due to anything other than “gross misconduct”. They can also qualify for COBRA if they had their hours reduced, or even retired early. Coverage can last between 18 and 36 months, depending on the nature of the “qualifying event,” or the reason for leaving, and the rules outlined in the employer’s healthcare plan.

An individual usually has 60 days the elect to receive coverage under COBRA after leaving the company, so long as they’re not covered by another plan. If the employee’s plan also covered their spouse or dependents while they worked at the company, they would be covered under COBRA also.

If the employee becomes eligible for Medicare, divorces the spouse, or dies, the spouse and dependents are still eligible for COBRA for at least 18 months, with the possibility of an extension.

How Much Does COBRA Cost?

While COBRA enables a former employee to retain coverage at group insurance rates, the individual is often required to pay both the employer and the employee’s portion, plus an administrative fee, driving up the costs significantly. Some companies may subsidize the cost of COBRA as part of a severance package for employees.

For those who suffered a job loss due to economic reason, a special tax credit may be available to help cover the costs of COBRA.

Can I Choose to Stop COBRA Insurance?

If you elect COBRA insurance and later decide it’s too expensive or you want to pick a new plan on the Health Insurance Marketplace, you may only do so during the Open Enrollment Period, which runs from November 1stto December 15th, unless you qualify for a Special Enrollment Period. If your COBRA Insurance is scheduled to end before the enrollment period begins, or your COBRA costs rise because of a change by your former employer, you will be able to choose a new plan during the Special Enrollment Period (within 60 days of the qualifying event).