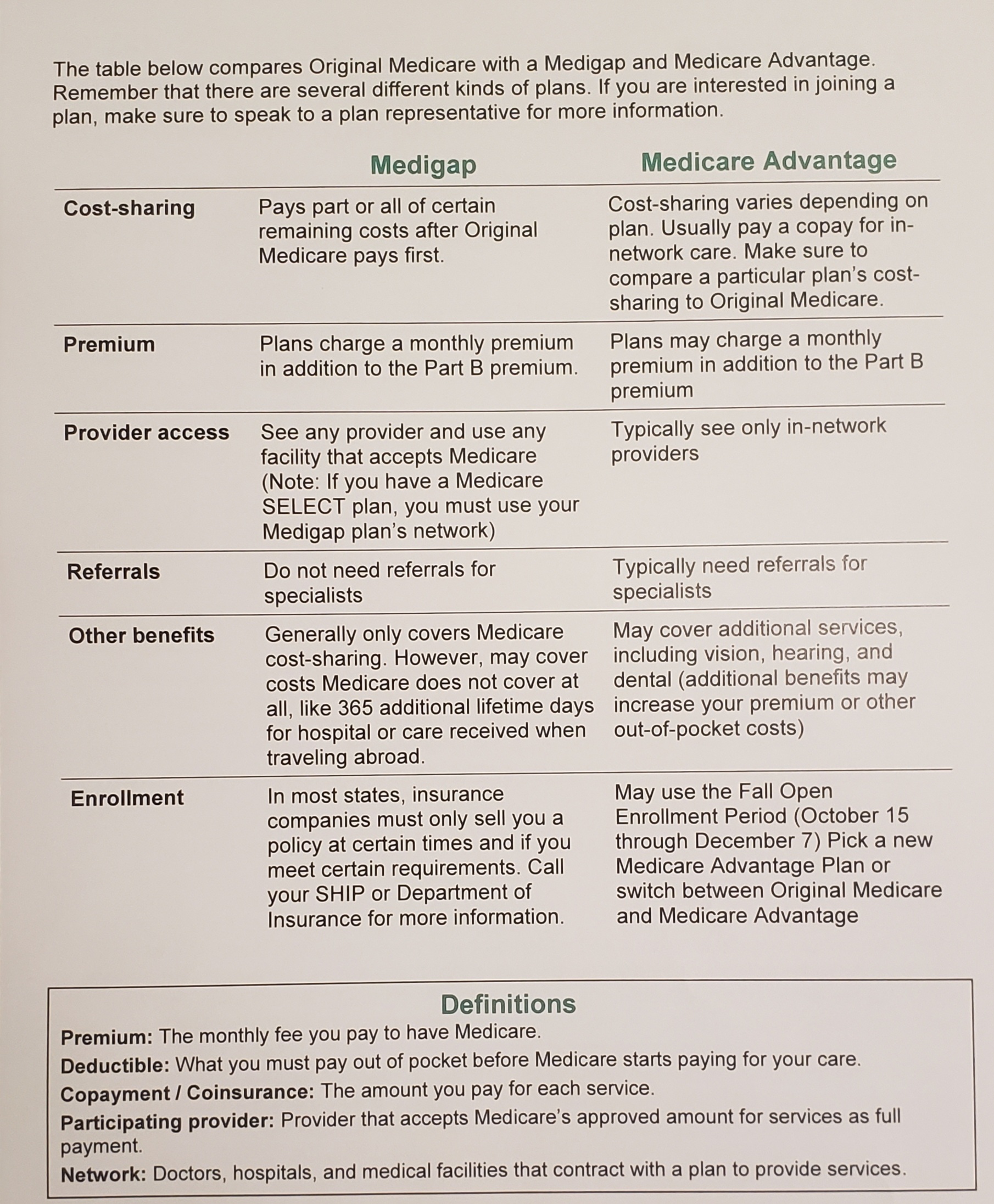

People with Medicare looking to fill gaps in their coverage and/or get assistance with Medicare costs can choose to enroll in a supplemental insurance policy (Medigap) in addition to Original Medicare or to enroll in a Medicare Advantage Plan. Here’s a look at the differences between these two options.

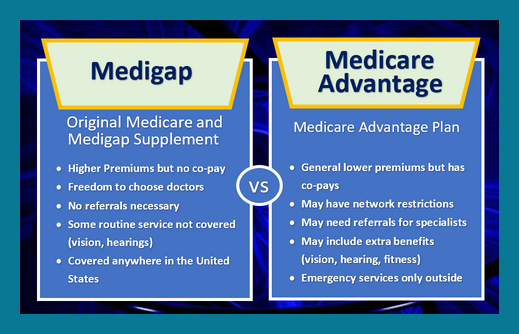

Medigap may help pay for Medicare deductibles, coinsurances, and copayments. Depending on where you live, and when you became eligible for Medicare, you have up to 10 different Medigap plans to choose from: A, B, C, D, F, G, K, L, M, and N. (Plans in Wisconsin, Massachusetts, and Minnesota have different set of benefits, but all plans with the same letter must offer the same benefits (regardless of the company you buy it from). Premiums vary depending on both the plan you choose and the company you buy it from.

Medicare Advantage Plans must provide at least the same set of benefits offered by Original Medicare, but they may have different rules, costs, and restrictions. For instance, Medicare Advantage Plans may require that you see health care providers in their network, and/or that you get a referral from your doctor before seeing specialists. Some Medicare Advantage Plans offer extra Medicare-excluded benefits, such as dental care.

If you sign up for Original Medicare and a Medigap and later decide you would like to try a Medicare Advantage Plan – or vice versa – be aware that there are certain enrollment periods when you are allowed to make changes. Additionally, Medigap enrollment rules vary by state. Familiarize yourself with your state’s rules before disenrolling from your Medigap.

Keep in mind that different areas have different Medicare Advantage Plans and Medigap options. A particular plan may not be available where you live. For assistance finding Medicare Advantage Plans in your area, call 1-800-MEDICARE or reach our to your local trusted advisors at Group Plans Inc by calling our main office at (623) 889-7600.