Most people are familiar with what Life Insurance is and are aware of it’s value as part of a financial plan for the future. It allows individuals a way to ensure the financial security of their loved ones in the event of the death of the insured. In addition to the financial security for the beneficiaries, certain types of Life Insurance can serve as an outlet for cash accumulation. The options for coverage can seem endless, with the variables of policy terms, endorsements, products and structure, and a variety of underwriting processes, however, this evolution and the growing possibilities of Life Insurance products over the years has left consumers with more access to cost-effective coverage to meet their individual and specific needs.

Roman Military Leader, Gaius Marius, started a “Burial Club” during the Roman Empire.

Life Insurance: A Roman Inception

Life Insurance is a notion and idea that has not surprisingly, existed for centuries. In 100 B.C. the Ancient Romans believed that anyone who was not given a proper burial, regardless of social structure, would return as an unhappy spirit or ghost, so it was of high importance to ensure that every single person who died was buried in the proper manner regardless of their individual social status. Just like today, funerals cost money, and they did in Ancient Rome as well. In order to ensure that cost would not be a barrier to following the proper protocol; Gaius Marius, a Roman military leader, started a “burial club” among his own troops. Referencing an article written in “LifeHealth Pro Magazine” about the history of Life Insurance, Gaius’ plan worked like this: Should a member of his troops die or be killed, the remaining members would pool together to cover his funeral expenses. Over time this practice even evolved to provide money to any survivors and was proportionate to the amount of shares the deceased member owned. With the fall of the Roman Empire, many of the empire’s objectives fell with it, however the idea that a human life holds value still held up over and throughout history.

Modernization of Life Insurance

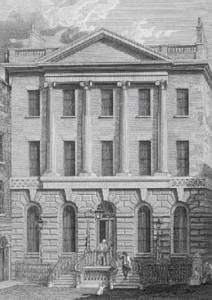

In 1688, Edward Lloyd’s Coffee House, a small shop on London Tower Street and a popular gathering place for ship captains, ship owners and merchants, became the new go-to place for shipping news, and eventually, marine insurance. It was here that the modern concept of an insurance company came into fruition. In 1769, a group of professional underwriters broke off to establish New Lloyd’s Coffee House, which eventually evolved and grew up into Lloyd’s of London which is now one of the world’s leading insurance markets that provides services to over 200 countries and territories.

Amicable Life Assurance Society, est. in 1706

The very idea that a human life had value and that it was possible to provide for the survivors of the deceased and cover funeral-related expenses with insurance was becoming more prevalent in modern society. The first “Life Table” was written by Edmund Halley in 1693, but it wasn’t until the 1750’s that the necessary mathematical and statistical tools were in place for the development of modern Life Insurance. James Dodson, a mathematician and actuary, tried to establish a new company aimed at correctly offsetting the risks of long-term life assurance policies, after being refused admission to the Amicable Life Assurance Society due to his advanced age. He was unsuccessful at procuring a charter from the government. His disciple, however, Edward Rowe Mores, was able to establish the Society for Equitable Assurances on Lives and Survivorship in 1762. It was the world’s first mutual insurer and it pioneered age-based premiums based on mortality rate laying the “framework for scientific insurance practice and development” and the “basis of modern life assurance upon which all life assurance schemes were subsequently based”.

Life Insurance in the United States of America

In the U.S.A., Life Insurance came up around 1759, through the Presbyterian Synods in Philadelphia and New York City. The widows and children of the Presbyterian ministers were the beneficiaries in the event of one of their deaths.

Toward the late 19th century, the idea of sharing risk and reward was again revisited when “tontines”, an annuity shared by subscribers to a loan or common fund, the shares increasing as subscribers die until the last survivor enjoys the whole income, became available through the Equilife Assurance Society. They were primarily developed to allow Equilife to compete in the market and they revolutionized the insurance industry at the time because they offered an investment option to middle-class Americans. Tontines were later eventually outlawed, at least in the U.K. and the United States, because they are not only morbid, but also because they give the members a financial interest in being the last survivor and because they were being abused and being shared by members with vastly different life expectancies.

Life Insurance continued to evolve, change, and develop as the population also grew, and was faced with risks such as war. In the 1870’s, military officers formed the Army and Navy Mutual Aid Association (now known formally as the AAFMAA or American Armed Forces Mutual Aid Association) to benefit the surviving children and widows after seeing first-hand the plight of those left behind after the many deaths at the Battle of Little Bighorn.

After WWII, America experienced an economic boom that resulted in a major boost in Life Insurance sales by the mid-1970’s. Almost 90% of husband and wife households had Life Insurance and 72% of adults owned a policy as well. Over the years, this number has dropped significantly (now 60%), despite the cost-effective coverage of Life Insurance today.

September is Life Insurance Awareness Month!

A Shift in the Structure of Life Insurance

Awareness campaigns and ongoing education can help enlighten consumers about the need for Life Insurance coverage. However, it’s critical that the cost-effective aspect is communicated in relatively the same way. By demonstrating the need for additional protection through a comprehensive understanding of individual circumstances, risks and financial planning sessions and then showing the solution through the presentation of an appropriate life insurance proposal, consumers can see that the value of a policy cannot be underestimated. With the right Life Insurance financial planning partner working with them to present appropriate insurance options, they will also begin to understand that life insurance can be cost-effective, as well.

Group Plans, Inc has been proudly assisting clients since 1977, assessing their individual situations, health risks, budget, and other options with plans that will suit your specific needs and allow you to feel a sense of security knowing you are leaving a legacy of protection and coverage behind, rather than burdensome expenses for your loved ones to assume.