Residents of Arizona can purchase affordable Health Insurance Plans through the state Marketplace, or low-income households may be eligible for coverage through Arizona’s Medicaid expansion.

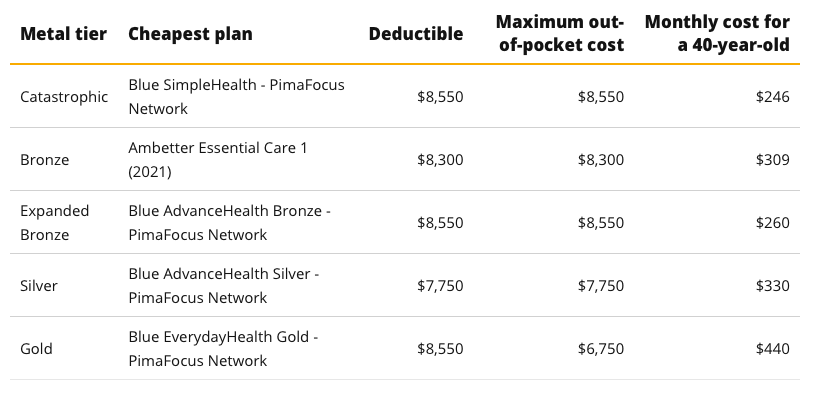

Cheapest Health Insurance Coverage by Metal Tier

Health Insurance plans on the Arizona exchange are divided into metal tiers, which indicate the benefits you would receive from a policy as well as its out-of-pocket costs and premiums. To help you find a cheap health insurance plan for yourself, we compare all those listed on the Arizona marketplace and identified the most affordable policies in each metal tier. Not all of these health insurance policies are offered in every county, but we recommend using these to et a sense of the costs and benefits you can expect in each tier of coverage.

The actual cost of a health insurance policy will vary depending on your age in addition to the policy you choose and the number of people covered. As you can see below, the cost of a health insurance plan in Arizona is 28% cheaper for a 21-year-old than for a 40-year-old, which translates to an average savings of $110 per month for the average Silver plan. A 60-year-old, on the other hand, would end up paying 112% more for the same level of coverage.

Which Major Medical Insurance Carriers are Available in AZ?

Arizona has 5 insurers available on the exchange.

- Blue Cross and Blue Shield of Arizona

- Bright Health Company of Arizona

- Cigna HealthCare of Arizona

- Ambetter/Health Net of Arizona

- Oscar Health Plan

While Arizona does have five Health Insurance Companies available on the Marketplace, depending on your zip code, you might not have access to them all; certain Arizona areas have only one or two insurance providers available.

Bright Health Company of Arizona and Oscar typically offer the most affordable plans in Arizona; however, not all counties will have access to them. Blue Cross and Blue Shield of Arizona is the only insurer available in every AZ county.

Metal Tier Breakdown

Gold Plans: Best if you have high expected medical costs

If you rely heavily on your health insurance, a Gold plan is most likely the best choice. The premiums are more expensive than a silver plan, but out-of-pocket expenses are significantly lower.

Silver Plans: Best for average medical costs or people with low income

Silver plans sit between Gold and Bronze plans and are a good option for people with average medical needs. Premiums are affordable, and the out-of-pocket expenses are lower than Bronze plans. If your income falls below 250% of the federal poverty level and you are enrolled in a Silver plan, you may qualify for discounts toward deductibles, copayments, and coinsurance.

Bronze Plans: Best for healthy people with low expected medical costs

Bronze plans have cheap premiums but high out-of-pocket costs and limited coverage. The low-cost coverage makes Bronze plans particularly well-matched to young and healthy individuals who don’t use their health insurance often. If you are considering the Bronze plan, you must ensure you have enough savings to cover the high out-of-pocket costs should an unexpected medical emergency occur.

For more information regarding Health Insurance in Arizona, please feel free to reach out at (623) 889-7600.