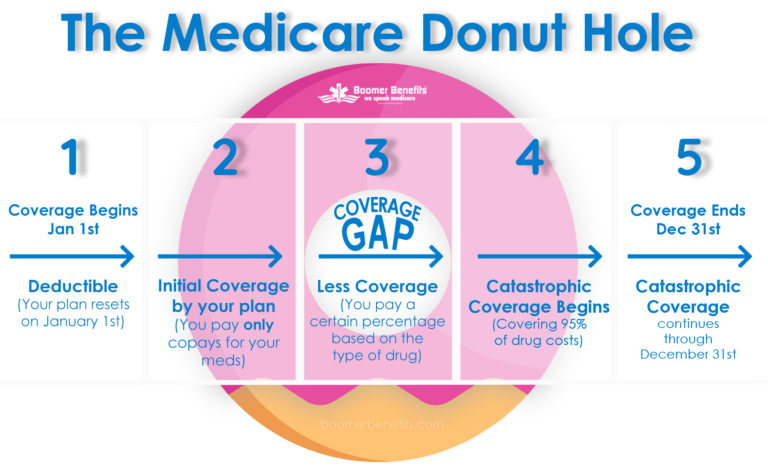

The Coverage Gap or Donut Hole (or Doughnut Hole, as it has been spelled both ways) has caused a considerable amount of confusion for many people when they suddenly realize they are required to pay a higher price (or before 2011, the full price) for their prescription medications. The following brief overview is based on the 2020 Medicare Standard Benefit Plan Model.

Quick Overview

According to the Centers for Medicare and Medicaid Services (CMS) the Standard Medicare Part D Prescription Drug Plan, the Donut Hole phase of your Medicare Part D coverage begins when your total retail drug costs reach $4,020. (In past coverage years, some Medicare Part D plans have implemented a different Initial Coverage Limit and have begun the Donut Hole phase a littler earlier, perhaps at a total spending limit of around $1,800.)

Please Note, this $4,020 is the total retail cost of the Medications, NOT what you spend personally at the pharmacy. As a Medicare Part D beneficiary, you will pay only a portion of the $4,020 and your Part D plan pays a portion. Your total retail cost of prescription medications is calculated from your Medicare Part D plan’s negotiated retail drug price – and every Medicare Part D plan can have a different negotiated retail drug price. So it is possible that you may reach the Donut Hole a littler earlier or later than someone else who uses the exact same prescription medications, but this other person has enrolled in a prescription drug plan from another Medicare Part D plan provider.

As a note, in the CMS model Medicare Part D plan, a beneficiary; like yourself, pays the first $435 dollars as an initial deductible and then is responsible for paying 25% of the next $3,585, for a total out of pocket medications cost, or “true out-of-pocket costs” (TrOOP) of $1,331.25 (excluding your monthly plan premiums.)

Again, following the CMS standard model Medicare Part D plan, when you reach the Donut Hole, your Medicare Part D plan will have paid the difference between the negotiated retail cost of all your drug purchases and your out-of-pocket cost, or $2,688.75.

However, most people simply say that you enter the Donut Hole phase of your Medicare Part D plan at the end of our Initial Coverage phase or when you reach your Medicare Part D plan’s Initial Coverage Limit (again, around $4,020)

With changes in the Medicare law, a $250 Donut Hole Rebate program was implemented in 2010. Anyone who reached the 2010 Donut Hole was automatically mailed a check for $250.

The 2011 Donut Hole marked the beginning of an effort at closing the Donut Hole. In 2011, anyone reaching the Donut Hole received a 50% discount on brand-name formulary drugs and a 7% discount on all generic formulary medications.

In 2020, anyone reaching the Donut Hole will receive a 75% discount on brand-name formulary drugs and a 75% discount on all generic formulary medication. So for your brand-name drug purchases, you will pay only 25% of the retail cost, but receive 95% credit toward meeting your Donut Hole exit point or TrOOP. For generic drug purchases, you pay 25% of the retail cost and receive the same 25% credit toward TrOOp.

You will stay in the Donut Hole until your TrOOp (True Out-of-Pocket) costs reach $6,350.

If you would like to learn more about the Medicare Part D Donut Hole or speak to a local trusted insurance advisor about any of your Medicare concerns, please contact us! Group Plan’s Inc is happy to help! (623) 889-7600.