How to Enroll In Medicare

There are several options you have when it comes time to enroll in Medicare. Medicare enrollment is automatic for some people, while others depend on when and how they become eligible.

You can enroll in Medicare Part A and/or Part B in these following ways:

In-Person at your local Social Security Office

Online at www.SocialSecurity.gov

By calling Social Security at 1-800-772-1213 (TTY users 1-800-325-0778) Monday through Friday from 7AM to 7PM.

If you worked at a railroad, you can enroll in Medicare by contacting the Railroad Retirement Board (RRB) at 1-877-772-5772 (TTY users 1-312-751-4701) Monday through Friday 9AM to 3:30PM to speak with an RRB Representative.

There are some situations in which Medicare enrollment may occur automatically, such as:

If you are receiving retirement benefits:

If you’re already receiving Railroad Retirements or even Social Security retirement benefits when you turn 65, you’ll automatically be enrolled in Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance) if you sign up for Medicare Part B at the same time you sign up for retirement benefits.

If you are living outside of the 50 United States or D.C. (For example, if you live in Puerto Rico) you will automatically be enrolled in Medicare Part A but will need to manually enroll yourself in Medicare Part B.

If you are receiving disability benefits:

If you are under 65 years old and receiving certain disability benefits from Social Security or the Railroad Retirement Board, you will also be automatically enrolled in Original Medicare, Part A and Part B, after 24 months of disability benefits received. The exception here would be if you have end-stage renal disease (ESRD). If you have ESRD and had a kidney transplant or need regular kidney dialysis, you can apply for Medicare. If you have ALS (Lou Gehrig’s disease), you will automatically be enrolled in Original Medicare the same month that your disability benefits start.

If you don’t want Medicare Part B:

If you ARE Automatically enrolled in Medicare Part B, but do not want to continue receiving this coverage, you have a few options to drop the coverage. If your coverage hasn’t started yet but you were sent a red, white, and blue Medicare card, you can follow the instructions that come with your card and then send the card back. If you keep the Medicare card, you also keep Part B coverage and will be required to pay Part B premiums. If you signed up for Medicare through Social Security, then you will have to contact them to drop the Part B coverage. If your Medicare coverage has already started and you want to drop Part B, contact Social Security directly for instructions on how to submit a signed request to eliminate your Part B coverage. At that point your coverage for part B will end the first day of the month after Social Security gets your request.

If you have health coverage through a current employer (This could be through your employer or through a spouse’s), you may decide to delay your Medicare Part B enrollment. Speak with the employer’s health benefits administrator so that you understand how your coverage works with Medicare and what the consequences or end results will be if you drop Medicare Part B.

Medicare Part B Late Enrollment Penalty

If you don’t sign up for Medicare Part B when you are initially eligible, you may need to pay a penalty for as long as you have Medicare. Your monthly premium for your Part B coverage could be 10% higher for every full 12-month period that you were eligible for Part B but didn’t take it. The higher premium could be in effect for as long as you are enrolled in Medicare. For those people who aren’t automatically enrolled, there are various Medicare enrollment periods during which you can apply for Medicare. Be aware that, with certain specific exceptions, there are late-enrollment penalties for not signing up for Medicare when you are initially eligible.

One exception is if you have coverage through and employer, whether yours or your spouse’s, you can delay Medicare Part B enrollment without paying a late-enrollment penalty. This health coverage must be based on the current employment, meaning that COBRA or retiree benefits are not considered current employer health coverage.

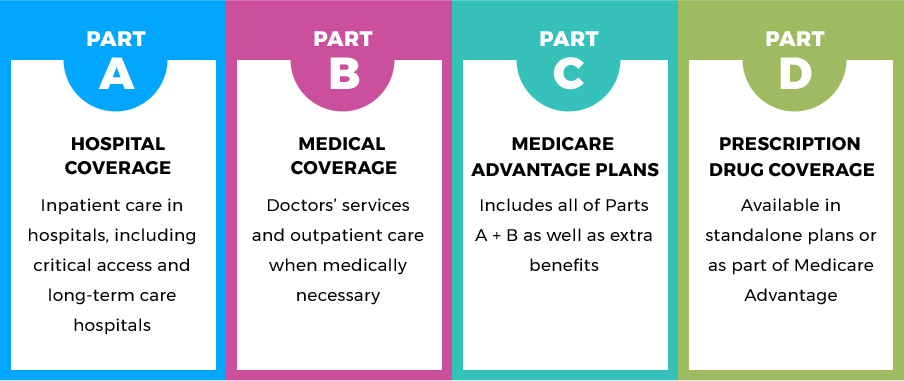

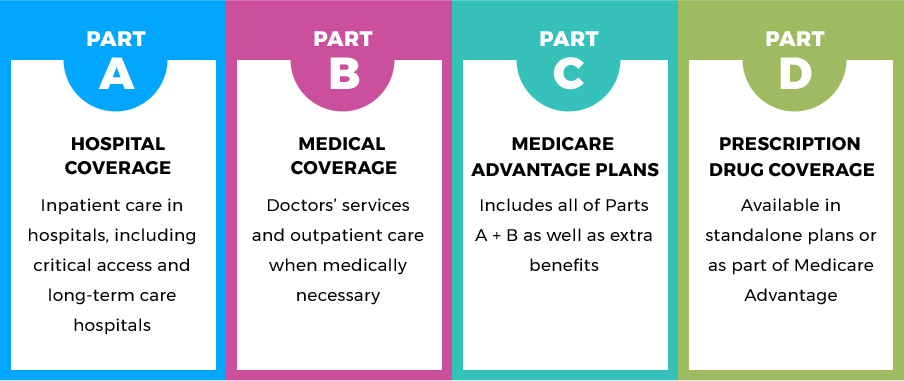

Medicare Part A, B, C and D all have different aspects of coverage. This graph briefly explains each part general area of coverage.

Medicare Initial Enrollment Period

Typically for most people, enrolling in Medicare Part A is automatic, however there are several instances where you have to enroll manually in Medicare Part A and/or Part B during your Initial Enrollment Period (IEP), the seven month period that begins three months before you turn 65, includes the month of your 65th birthday and ends 3 months later.

Some situations where you would enroll in Medicare during your Initial Enrollment Period would include:

If you aren’t receiving retirement benefits: If you are not yet receiving retirement benefits and are getting close to turning 65, you can sign up for Medicare Part A and/or Part B during your IEP. If you do decide to delay your Social Security retirement benefits or Railroad Retirement Benefits (RRB) beyond age 65, there is an option to enroll in just Medicare and apply for retirement benefits later.

If you do NOT qualify for retirement benefits:

If you aren’t eligible for retirement benefits from Social Security or the RRB, you will not be automatically enrolled into Original Medicare. However, you can still sign up for Medicare Part A and/or Part B during your IEP. You may not be able to get premium-free Medicare from Part A, and the cost of your monthly Part A premium will depend on how long you worked and paid Medicare taxes. You will still have to pay a Medicare Part B premium.

Medicare General Enrollment Period

If you did not enroll during the IEP when you were initially first eligible, you can enroll during the General Enrollment Period. The general enrollment period for Original Medicare is between January 1st through March 31st of each year. Keep in mind that you may have to pay a late enrollment penalty for Medicare Part A and/or Part B if you did not sign up when you were first eligible.

Medicare Special Enrollment Period

You may choose not to enroll in coverage with Medicare Part B when you are fist eligible because you are already covered by group medical insurance through and employer or through a union. If you lose that group insurance or if you decide to switch from your group coverage plan to Medicare, you can sign up at any time that you are still covered by the group plan or during a Special Enrollment Period (SEP).

Your eight-month special enrollment period begins either the month that your employment ends or when your group health coverage ends, whichever comes first. If you do enroll during an SEP, you generally are not required to pay a late enrollment penalty.

The Special Enrollment Period does not apply if you’re eligible for Medicare because you have ESRD. Please also keep in mind that COBRA and retiree health coverage are not considered current employer coverage and would not qualify you for an SEP.

Medicare Advantage Plan Enrollment

Medicare Advantage, also known as Medicare Part C, is yet another way to receive Original Medicare benefits and is offered through private insurance companies. At minimum, all Medicare Advantage plans must offer you the same Medicare Part A and B benefits as Original Medicare. Some Medicare Advantage plans also include additional benefits, like prescription drug coverage. You must have Original Medicare, Part A and B, to enroll in a Medicare Advantage Plan through a private insurer.

You can enroll in a Medicare Advantage plan during two enrollment periods; the Initial Coverage Election Period and Annual Election Period.

Medicare Advantage plan Initial Coverage Election Period

Most beneficiaries are eligible initially to enroll in a Medicare Advantage plan during the Initial Coverage Election Period. Unless you delay Medicare Part B enrollment, this enrollment period takes place at the same time as your IEP (Initial Enrollment Period), starting three months before you have both Medicare Part A and Medicare Part B and ending on whichever of the following dates falls later:

The last day of the month before you have both Medicare Part A and Part B

The last day of your Medicare Part B IEP

If you are under 65 and eligible for Medicare due to disability, your IEP will vary depending on when your disability benefits started.

Medicare Advantage plan Annual Election Period

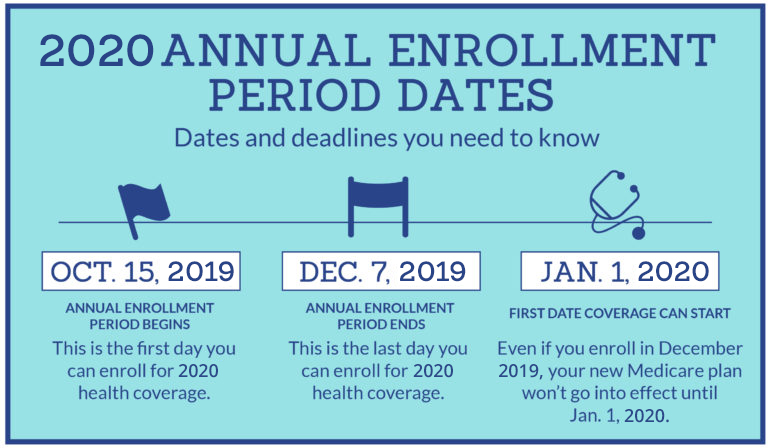

You may also add, change, or drop your Medicare Advantage plan during the Annual Election Period, which occurs from October 15th to December 7th every year. During this period, you may:

Switch from Original Medicare to a Medicare Advantage Plan and vice versa.

Switch from one Medicare Advantage Plan to a different one.

Switch from a Medicare Advantage Plan without prescription drug coverage to a Medicare Advantage plan that does cover prescription drugs, and vice versa.

Medicare Advantage Disenrollment Period

You will have the opportunity to disenroll from your Medicare Advantage plan and return to Original Medicare during the Medicare Advantage Disenrollment Period, which runs from January 1st to February 14th. You cannot use this period to switch Medicare Advantage plans or make other changes. However, if you do decide to drop your Medicare Advantage plan, you can also use this period to join a stand-alone Medicare prescription drug plan, since Original Medicare doesn’t include drug coverage.

Outside of the Annual Election Period and the Medicare Advantage Disenrollment period you cannot make changes to your Medicare Advantage plan unless you qualify for a Special Election Period.

Medicare Prescription Drug Coverage

Medicare Prescription Drug coverage is optional and does not occur automatically. You can receive coverage for prescription drugs by either signing up for a stand-alone Medicare prescription drug plan, or a Medicare Advantage plan, also known as a Medicare Advantage Prescription Drug plan. Medicare prescription drug plans and Medicare Advantage plans are available through private insurers. Please remember that you cannot have both a stand-alone Medicare Prescription Drug plan and a Medicare Advantage plan that includes drug coverage.

Initial Enrollment Period for Medical Part D

You can enroll in a stand-alone Medicare prescription drug plan during your Initial Enrollment Period for Part D. You are eligible for drug coverage if:

You live in a service area covered by the health plan, and

You have Medicare Part A and/or Medicare Part B.

Generally, your Initial Enrollment Period for Part D will happen at the same time as your Initial Enrollment Period for Medicare Part B (The seven month period that starts three months before you eligibility for Part B, includes the month you are eligible, and ends three months later.)

Once you are eligible for Medicare Part D, you must either enroll in a Medicare prescription drug plan, Medicare Advantage Prescription Drug Plan, or have creditable prescription drug coverage (coverage that is expected to pay at least as much as standard Medicare prescription drug coverage). Some people may choose to delay their Medicare Part D enrollment if they already have creditable drug coverage through an employer group plan.

If you do not sign up for prescription drug coverage when you are first eligible for Part D, however, you may have to pay a late-enrollment penalty for signing up later if you go without creditable prescription drug coverage for 63 more consecutive days.

If you need help navigating through your options for Medicare, we at Group Plans, Inc can help you! Contact us today to schedule an appointment to go over your insurance benefit options.

Medicare Part D Annual Election Period

If you did not enroll in drug coverage during an IEP, you can sign up for prescription drug coverage during the Annual Election period that runs every year from October 15th to December 7th.

During an Annual Election Period you can do the following:

Sign up for a Medicare prescription drug plan.

Drop a Medicare prescription drug plan

Join a Medicare Advantage plan that includes prescription drug coverage.

Switch from a Medicare Advantage plan that doesn’t include drug coverage to a Medicare Advantage plan that does (and vice versa).

Outside of the Part D Initial Enrollment Period and the Annual Election Period, the only time you can make changes to prescription drug coverage without a qualifying Special Election Period is during the Medicare Advantage Disenrollment Period (MADP)- but only if you are dropping Medicare Advantage coverage and switching back to Original Medicare. The Medicare Advantage Disenrollment Period runs from January 1st to February 14th.

Medicare Part A and Part B do not include Prescription drug coverage, and if you switch back to the Original Medicare during the Medicare Advantage Disenrollment Period, you will have until February 14th to join a stand-alone Medicare prescription drug plan.

Medicare Supplement Insurance Plans Enrollment

Medicare Supplement insurance plans (or Medigap) are voluntary, additional coverage that help fills the gaps in coverage for Original Medicare. The best time to enroll in a Medicare Supplement insurance plan is during your individual Medigap Open Enrollment Period, which is the six-month period that begins on the first day of the month you turn 65 and have Medicare Part B. If you decide to delay your enrollment in Medicare Part B for any certain reason such as having health coverage through a current employer, your Medigap Open Enrollment Period will not begin until you sign up for Part B.

During your Medigap Open Enrollment Period, you have a “guaranteed-issue right” to buy any Medigap plan sold in your state. This means that insurance companies cannot reject your application for a Medicare Supplement insurance plan based on pre-existing health conditions or disabilities. They also cannot charge you a higher premium based on your health status. Outside of this open enrollment period, you may not be able to join any Medigap plan you want, and insurers can require you to undergo medical underwriting. You may also have to pay more if you have health problems or disabilities.

Medigap plans, like Medicare Advantage plans, are offered through private insurance companies, and are available for purchase through brokers like eHealth Insurance Services, Inc.

You can find and navigate through the Medicare Terminology Glossary HERE to better understand the specific names and definitions of each aspect of Medicare, including all that are listed above!

If you would like assistance or to speak with an experienced and Licensed Insurance Professional to better understand the Medicare Plan options available and find a plan that is right for you, then please don’t hesitate to give us a call at Group Plans, Inc at (623) 889-7600. We would be happy to assist you with all your insurance inquiries as well as set up an appointment to go into more detail, free of charge.