Medicare itself can be confusing and complex, with the hundreds of pages of explanation offered by Medicare.gov, but a relevant and common mixup is the difference between Medicare Supplement Insurance and Medicare Advantage. Also known as Medigap, Medicare Supplement Insurance is coverage that you can add to Original Medicare Parts A and B. Medicare Advantage, also known as Medicare Part C is an alternative to Original Medicare Part A and B. It’s a different way to receive your Medicare benefits.

Both Medicare Advantage plans and Medicare Supplement Insurance plans are offered by private insurance companies approved by Medicare. With either option, you continue to pay a monthly Part B premium to Medicare. The important things to think about when trying to make a decision between them are:

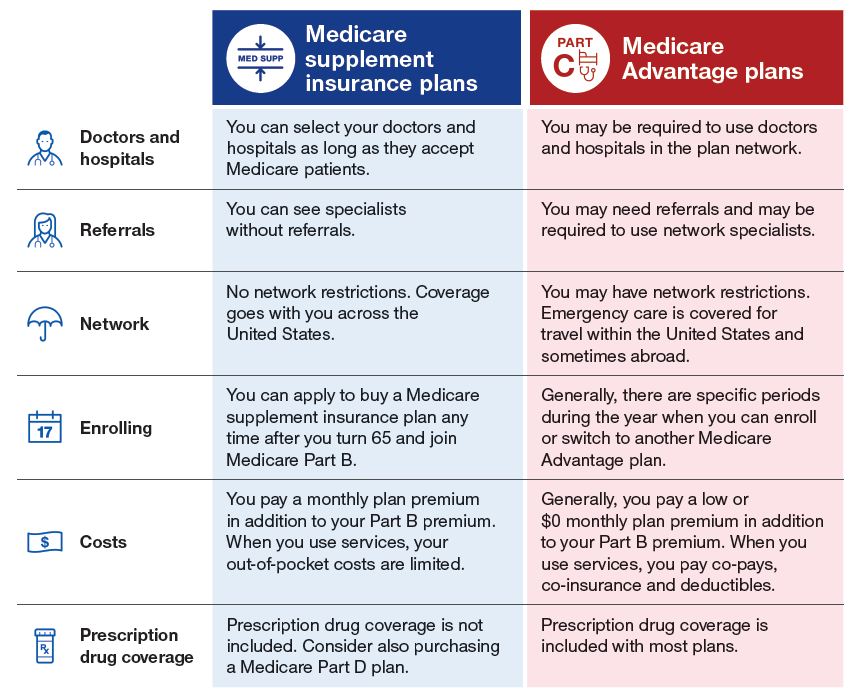

- Are you willing to select a provider from within a provider network, or do you want the choice of any provider?

- Would you have drug coverage included in one plan, or would you rather buy a separate drug plan?

- Would you rather pay a low, or $0 monthly premium and copays for services as you use them, or would you rather pay more in monthly premiums and have lower out-of-pocket costs for services you receive?

It would first help to know some of the main differences between Medicare Supplement Insurance and Medicare Advantage! Check out the infographic below for a side by side comparison regarding how these plans compete.

More Information About Medicare Costs

It’s always a great idea to look at the whole picture of your health care needs, before deciding between Medicare Supplement Insurance and Medicare Advantage. Think about how you will actually apply or use your benefits and consider all the costs of Medicare.

The purpose of a Medicare Supplement Insurance plan is to help pay some of those out-of-pocket costs that are not paid for by Original Medicare (parts A and B), like deductibles, co-pays, and co-insurance. There is no cap on these costs with Original Medicare, and different plans pay different costs. You will pay a monthly Medicare Supplement Insurance plan premium, the Medicare Part B premium and a premium for a for a prescription drug plan, if you decide you want one.

The purpose of Medicare Advantage plans are to provide all of your coverage, including drug coverage, in one plan, similar to employer plans you may have had. You pay a low or $0 plan premium and a co-pay or co-insurance when you receive a health care service. Medicare Advantage plans are required to cap your annual ou-of-pocket costs. Premiums do not count toward the cap. You continue to pay the Part B premium to Medicare.

These are the basic outlines of both Medicare Advantage versus Medicare Supplement Insurance, however, as they say, the devil is in the details so it’s important to go over your plan and benefits with an expert in order to ensure you have the best insurance option for your family.