If you are currently enrolled in Medicare but are still worried about the potential cost of your Health Care, your chance to make changes is just around the corner.

Open Enrollment is the time to re-evaluate your coverage!

Generally, most people who enroll in Medicare at the age of 65 when they become eligible. Every fall, they have the opportunity to change their coverage during Open Enrollment season, which runs from October 15th through December 7th.

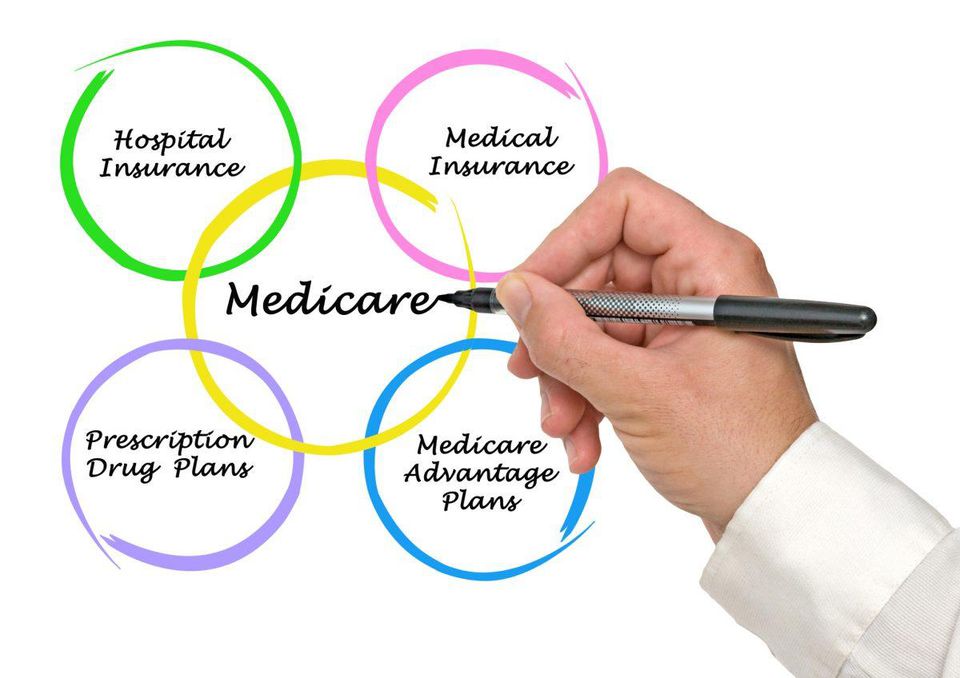

During this designated time-frame you can switch between original fee-for-service Medicare and Medicare Advantage, which is the all-in-one managed care alternative to the traditional program. You can also choose to re-evaluate your prescription drug coverage, whether it’s a stand-alone Part D plan or wrapped into an Advantage Plan.

Checking up on your coverage is a great idea, even if you are happy with your current plan and choices. Often times Prescription Drug plans revise their list of covered drugs, the rules under which they will be covered and their cost sharing as well. If you’re currently enrolled in a Medicare Advantage plan, it’s a good time to determine if your Health Care providers will be in your plan during the coming year, and whether a switch to Original Medicare makes sense for you or not.

Somehow, even with this information and yearly opportunity for change, few Medicare enrollees take advantage of the Fall Open Enrollment. One example, according to research done by the Kaiser Family Foundation shows that a slim 11% of Medicare Advantage enrollees voluntarily switch plans each year. Another study conducted in 2013 by the same foundation concluded that just 13% of Medicare Part D enrollees switch voluntarily. Yet nearly half of those who did switch plans cut their premium at least 5 percent for the following year.

People are well aware that they should shop and compare, but it’s a lot of work, and they’re not confident they will be able to choose a plan that provides better value. This is where seeking advice from an experienced Insurance Professional, like and agent or broker, is a great tactic, because they will be able to help guide you in choosing a plan, free of charge.

Fall Enrollment offers the opportunity to make sure you’re getting the best coverage and to save some money on premiums and other out-of-pocket costs.

The most common and basic Medicare Enrollment decision is whether or not to use original fee-for-service Medicare or an Advantage plan. Most of the 64 million people enrolled in Medicare this year use the original program, but 34 percent are in Advantage plans.

Medicare Advantage Plans often include extra benefits, including some level of dental coverage, vision, hearing services and sometimes, gym memberships. This year, most Medicare Advantage enrollees, roughly 88% of them, are in plans that include drug coverage, and more than half of them, about 56%, pay no additional drug premium beyond their Medicare Part B premium. The trade-off is that Medicare Advantage enrollees must use health care providers within their networks, or pay more for out-of-network services.