Now that Open Enrollment has come to a close, and a new year has begun, you may find yourself in a pickle if you were unable to obtain insurance during the Open Enrollment Period. There are still options available for those who qualify, by using what’s called a Special Enrollment Period.

A Special Enrollment Period is a 60 day timeframe when you’re allowed to make changes to your Health Insurance plan, even though it’s not during the regular enrollment period. Special Enrollment Periods are standard with Health Insurance you get through an employer. Normally, you’re not allowed to sign up for Health Insurance or make any health plan changes except during the Annual Open Enrollment Period.

However, certain major qualifying events will trigger a Special Enrollment Period allowing you to make changes for a certain period of time after triggering the event. If you don’t make the necessary changes to your Health Insurance during the Special Enrollment Period (SEP), then you will have to wait until the next Open Enrollment period to make changes.

Why Do We Have Open & Special Enrollment Periods?

Open Enrollment and Special Enrollment Periods also apply to guaranteed-issue individual health insurance plans. That’s because health insurers are prohibited from denying individual health insurance coverage to people because of a pre-existing condition.

The Open Enrollment Periods ensure that individuals and families don’t wait until they get sick to enroll in coverage, or switch to more comprehensive coverage when they’re about to have an expensive medical procedure.

How Long Do I Have to Enroll After a Qualifying Event?

You have 60 days from the date of your qualifying event to get a new health plan.

What is Considered a Triggering Event for a Special Enrollment Period?

Individuals and enrollees are able to enroll in a QHP (Qualified Health Plan) or change from one plan to another outside the Open Enrollment Period as a result of the following ‘Qualifying Events’.

- A qualified individual or dependent loses minimum essential coverage.

- A qualified individual becomes newly eligible for a QSEHRA or an ICHRA (Qualified Small Employer HRA or Individual Coverage HRA).

- A qualified individual gains a defendant or becomes a defendant through marriage, birth, adoption or placement for adoption.

- An individual, who was no previously a citizen, national or lawfully present individual gains such status.

- A qualified individuals enrollment or non-enrollment in a QHP is unintentional, inadvertent, or erroneous and is the result of error, misinterpretation, or inaction of the exchange or HHS.

- An enrollee adequately demonstrates to the Exchange that the QHP in which he or she is enrolled substantially violated a material provision of its contract in relation to the enrollee.

- An individual is determined newly eligible or newly ineligible for advance payments of the premium tax credit or has a change in eligibility for cost-sharing reductions, regardless of whether such individual is already enrolled in a QHP. (The Exchange must permit individuals whose existing coverage through an eligible employer-sponsored plan will no longer be affordable or provide minimum value for his or her employer’s upcoming plan year to access this Special Enrollment Period prior to the end of his or her coverage through such eligible employer-sponsored plan.)

- A qualified individual or enrollee gains access to new QHPs as a result of a permanent move.

- An American Indian/Native American may enroll in a QHP or change from one to another one time per month

- A qualified individual or enrollee demonstrates to the Exchange that the individual meets other exceptional circumstances (as defined by the Exchange).

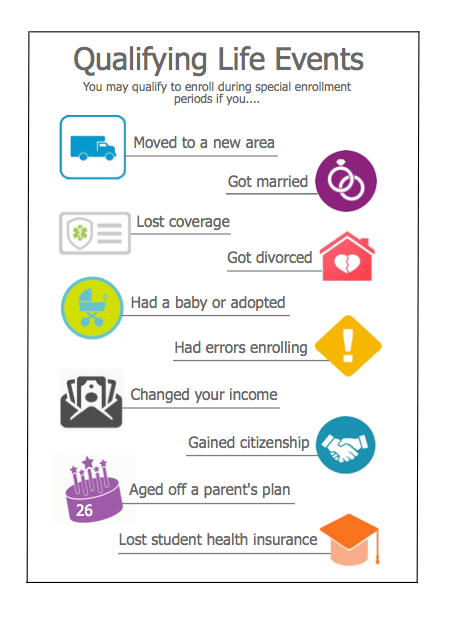

Some of these Qualifying Events broken down more simply could be any of the following:

- Losing your health coverage through a life event.

- Examples of these life events include: getting a divorce, losing your job, losing your Medicaid or CHIP eligibility, or expiring COBRA coverage

- Please note: If you voluntarily quit your health plan or are terminated because you didn’t pay your premiums, you are not eligible for a special enrollment period.

- Getting married.

- Having or adopting a child.

- Permanently moving somewhere with different health insurance options.

- Aging off your parent’s health insurance plan, or aging into Medicare.

- Having a change in income or household status that changes your eligibility for tax credits or cost-sharing reductions.

- Your plan being involuntarily canceled by your insurance company.

Health insurance Special Enrollment Periods typically last for 60 days after the date of your qualifying event. During this time, you can shop for health insurance on a private or public exchange. You’ll have the same plan options as you would during open enrollment, like copay plans, Health Savings Account (HSA)-compatible plans and a Young Adult plan. You may also have choices for dental plans and vision plans.

Be sure to purchase coverage during your Special Enrollment Period. If you miss that period, you will have to wait until the next Open Enrollment Period. However, you can buy a short-term health plan to cover yourself for a short period of time, which is highly recommended as you never know when illness or injury will happen.

Do I Need Documents to Prove My Qualifying Event?

Yes! When you enroll during a Special Enrollment Period, you will be required to provide certain documentation that proves you qualifying event took place. This documentation varies depending on the event, but overall it would need to have:

- An official letterhead, if it’s from a hospital, insurer, or employer.

- Your full name and any covered defendants who are also losing coverage.

- Provide important dates related to the qualifying event.

I think I’m eligible for Medicaid or CHIP. Do I need a qualifying event to sign up?

You do not! Government health programs, like Medicaid and CHIP, don’t have enrollment periods. If you’re eligible, you can sign up at any time.

I missed a premium payment and my plan was cancelled. Is that a qualifying event?

Unfortunately, no. If your plan is cancelled because of a failure to pay, you’ll need to wait until the next Open Enrollment Period to get new health insurance. Keep in mind that most insurance companies offer a grace period (usually 90 days) for late payments. You can also always call your insurance company, explain what happened, and try to negotiate a reinstatement.

We’re moving within the same state. Is that a qualifying event?

That depends! If you relocate somewhere with options you didn’t have access to before, that’s considered a qualifying event. You’re also eligible for an SEP if you move to a new county where your current plan is not available.

When will my coverage start if I apply during Special Enrollment Period?

Once you enroll, your health insurance will typically kick in on the first day of the following month. This depends on your qualifying event, though. Some qualifying events (like having a baby) “trigger” your effective date. You can learn more about how this works here.

Any secret ways to get around those Special Enrollment requirements?

The only way to obtain insurance in the immediate future is if you have a qualifying event. However, it’s not unheard of to, er, “induce” a qualifying event just to get covered… if you’re looking for one more reason to pop the question, buy that new home, or quit the 9-5 to follow your dreams and go freelance, maybe now’s the time!

Who can I reach out to?

If you or someone you know qualifies for a Special Enrollment Period and would like to shop your options and get some quotes, please contact us directly at (623)-889-7600 or fill out the simple contact form below!

If you or someone you know is turning Medicare age in 2020, please contact us for information regarding you Initial Enrollment Period, which starts the 3 months before you turn 65, the month of your qualifying birthday, and 3 months after.