Why Should I Consider Group Health Insurance?

Owning a small business, it’s important to do everything you can to protect it. Risks aren’t just for large enterprises or big conglomerates; even small businesses are prone to disasters and illness. An emergency situation can arise at any time and this is why it is so important for you to have small business insurance. There are a handful of incentives to having Group Health Insurance, which we will cover in this post!

Lower Premiums: Group Insurance Health Plans tend to be cheaper on average than for individual plans. Group Health Insurance is often cheaper because of the size of the risk pool. Individual health insurance spreads risk over a much larger group. According to the SBA (Small Business Administration), when a greater number of people pay for their health insurance in a group plan, average costs become more stable. As a result, the insurance company has more resources to draw from when someone needs medical care. This also means that the high cost of any one person ends up having a smaller effect on the average cost as the group becomes larger.

Tax Incentives: Businesses can actually deduct the cost of their premiums from federal business taxes, and some small businesses may qualify for a tax credit. Generally, employers can deduct 100% of the cost of monthly premiums they pay on qualifying group health plans from their federal taxes. It could also potentially mean your business may benefit from reduced payroll taxes. Employers can usually deduct HSA contributions from their small business taxes as well.

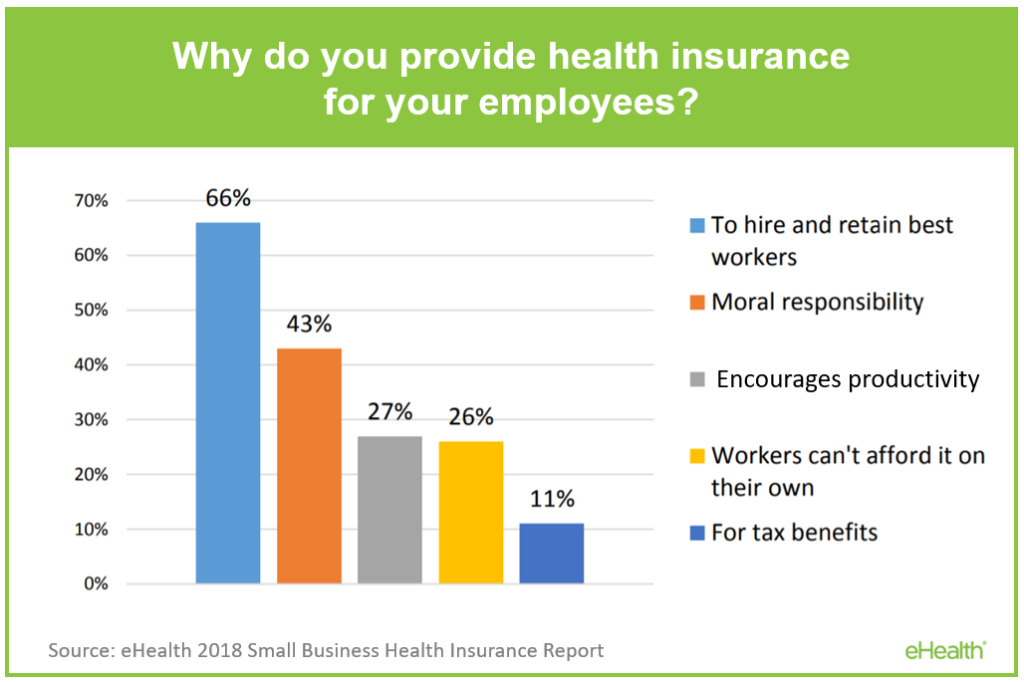

Improve Hiring and Recruiting: Studies show that businesses who offer their employees a comprehensive business package are more likely to attract employees. It appeals to both new-hires as well as current employees, setting you apart from other places of employment, as an employer of choice. 66 percent of small business say they offer medical employee benefits in order to help them hire and retain their employees. 33 percent of people have turned down a job due to lack of benefits offered. 57 percent of U.S. job candidates said benefits are at the top of their considerations before accepting a new job. 88 percent said being offered health insurance might tip them toward choosing a lower paying job over a higher paying job.

Employee Retention and Loyalty: Not only does a Group Health Insurance plan help attract new, quality employees, it also helps retain current top employees, as a comprehensive benefits package from the employer is valuable and not always easy to find when job searching. The value of offering health insurance helps retains employees from finding jobs elsewhere that provide benefits and encourages company loyalty without increasing the pay or wage of the worker.

Employee Job Satisfaction: Having happy employees who are content with their jobs and health benefits can ultimately lead to happier employers as well. Out of a list of 54 employee benefits, the following three basic employee benefits displayed the highest correlation with employee satisfaction: Health Insurance, Paid Time Off/Vacation (PTO), and Retirement planning options like 401(k) and pensions.

Healthier, More Productive Employees: When a worker takes fewer sick days and has less absences, they can retain focus and achieve more while having access to health care resources when they are needed, bringing a sense of comfort and security. According to a recent study, having health insurance any time throughout the year is significantly associated with a lower likelihood and reduced number of missed workdays. Generally, healthy employees tend to work more effectively and efficiently than employees who are ill. Healthier employees can also be lower labor costs. Unhealthy workers may retire or quit early, which can lead to costly turnover.

Foster a Healthy Company Culture: By showing your employees that their health is important to you, you promote a positive culture, encouraging wellness. A virtuous organization or business culture would include an increase in positive emotion and well-being at work, improving relationships and amplifying abilities and creativity, as well as offering a buffer against stress. An increased attention to wellness enhances employee satisfaction and productivity.

Pre-Tax Benefits for Employees: Another benefit of providing Small Business or Small Group Health Insurance can be more after-tax money available for workers. When an employer offers a Group Health Insurance Plan, the company takes part of employee’s premiums out of their paycheck before taking out federal income and state taxes. The employer can essentially lower the taxes their employees have to pay through reducing the taxable income of their workers. As a result, the tax payments that would have gone to the government for that income, can now go toward compensating the company’s employees.

Places Health Coverage Within Reach of Employees: One reason an employer would offer Group Health Insurance is to make medical coverage more accessible and more affordable to their employees, which as we have learned can lead to a more quality, long term position for the employees. Implementing a small group plan can help some of your employees enroll in a more affordable plan than they might otherwise have access to on the individual market.

How to Shop for Small Group Health Insurance

As experienced Small Group Health Insurance brokers, we at Group Plans Inc can help you shop around and help you weigh the pros and cons of plans available for your small business or group. We are also available to help answer your questions for the entire time you have your plan as well as be your advocate when you need to resolve questions or concerns with the insurance company. Our service is free to you, so you can rest assured that you are getting the best options available to choose from, versus being caged into just a few options from a specific insurance company agent. Brokers have more flexibility with options and products they can show you, as well as guide you through the process completely. If you are interested in more information or in a quote for Group Health Insurance, give us a call at 623-899-7600 or fill out the form below!