Buying a health insurance plan is a big investment, so make sure you ask your broker the right questions before spending any money.

How much will it cost?

Let’s go straight to the hardest question! How much your health insurance will cost you depends on your premium, deductible, and out-of-pocket max. When you’re shopping for a plan, it’s important to know what these 3 costs will be upfront, because they vary across health plans and will definitely impact what you owe.

- Premium: The first bill you will receive is for your premium, which is the amount you pay monthly to stay covered. If you have a $200 premium per month, it adds up to $2,400 annually.

- Deductible: If you have a deductible of $3,000, that means you’ll pay for the first $3,000 of care before your insurance starts paying for certain benefits. You are perhaps asking, “Well, why do I even need insurance if I’m paying doctor bills anyway?”. The benefit of insurance is that you pay a negotiated rate, which is usually below the full price. Plus, all the money you spend is tracked, and when you hit your deductible, you’ll pay much less.

- Out-of-pocket max: If you have an out-of-pocket max of $5,000 and you end up needing a procedure that costs $55,000, you’re only responsible for $5,000. If you already hit your $3,000 deductible, then you’re only responsible for $2,000. In summary: $3,000 is a big chunk of change, but it’s much better than owing the 55k you’d be responsible for if you weren’t insured. The out-of-pocket max is there to protect you from huge bills, but you still need to make sure you’re getting your procedure done at an in-network hospital.

Which plan is right for me?

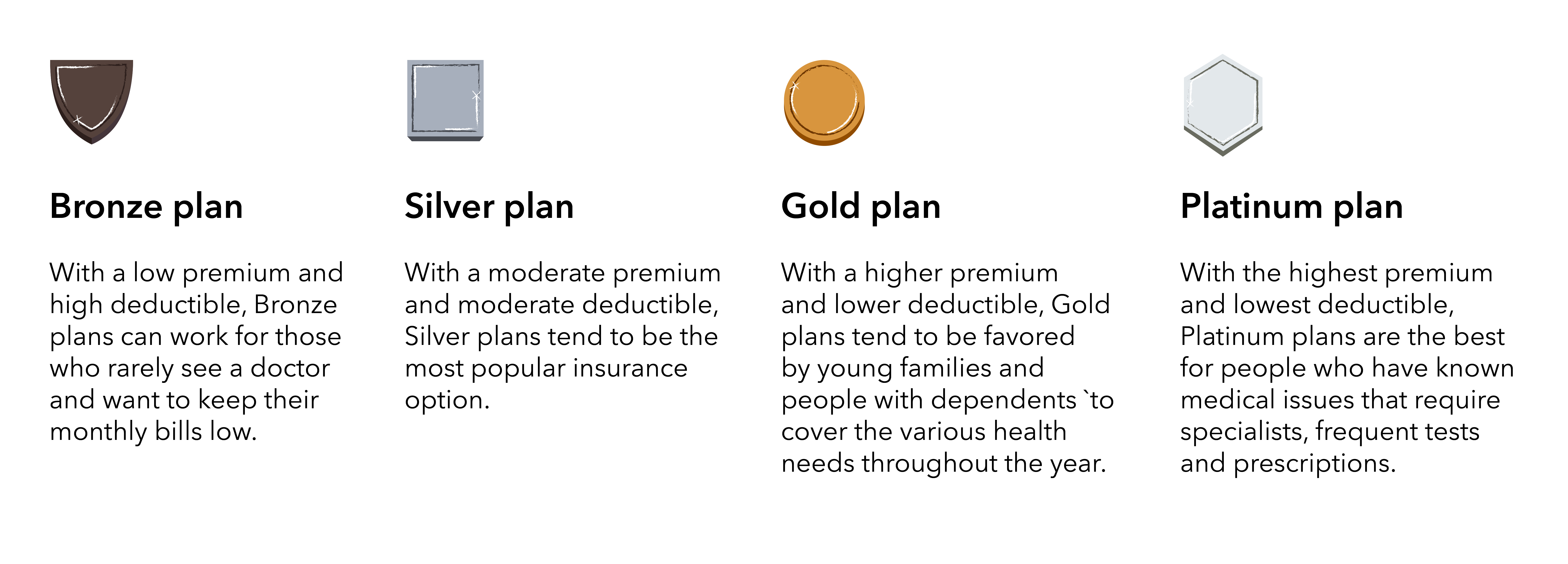

To answer this question, you’ll need to pick your metal tier, which will determine how much you’ll pay per month and how high your deductible will be. This chart explains the differences between each tier-which one is right for you depends on the amount of care you anticipate you’ll need in the next year.

When it comes to choosing a tier, everybody’s different. If you’re a fitness nut who wants to make sure you’re covered in case of an emergency and keep your monthly premium bill to a minimum, Bronze or Silver is a good choice. But if you’re dealing with a more complicated medical issue that requires tests, surgery, and prescriptions, Gold or Platinum plans with a low deductible are a better way to save you money throughout the year.

Is my doctor covered?

Another important thing you should consider when picking a plan is if your doctor, therapist, clinic, hospital, etc. will be covered. If you want to stick with your current doctor, be sure to check that they are in your health insurance company’s network of providers. If there are prescriptions or medical equipment you rely on, check the formulary to make sure they are also covered. If you want to find out if your doctor or prescription is covered, you can check each provider’s directory.

Is there someone I can call when I have questions?

Does your prospective insurance carrier have a customer service team you can contact when you have questions about bills, claims, or copays? Is there somebody you can call when you need help finding a doctor? When you call, will you get an automated phone system or an actual human being?

As your insurance broker, Group Plans Inc can assist you with all of your questions and concerns, as well as the member services department for your carrier.

What happens if there is an emergency?

Sometimes emergencies occur and you need to see a doctor right away. When this happens you should go to the closest ER, or call 911. For regular care, it’s important that you make sure that your doctor is in-network, but in an emergency situation this may not be possible. In a true emergency, the hospital will work with your health insurer on any authorizations you need. You can receive as many emergency services as you need and they will be covered by your plan until you’re considered “stable,” meaning you will be okay on your own without immediate medical attention. However, if you are stable but still need follow-up care, this may not be covered if the provider is out-of-network. Be sure to follow up with an in-network provider in order to take advantage of your plan’s benefits.

What are the perks?

Finally the good stuff! Be sure to ask if there are any sweet perks that come with your plan, things like telemedicine (calling a doctor), rewards, and free classes may be included, and occasionally free health tech. There may also be perks in the form of tax credits. Be sure to ask your broker if you qualify for any tax credits based on your income.

If you or someone you know has any questions about Health Insurance, please don’t hesitate to contact Group Plans Inc at (623) 889-7600 or fill out the contact form below and someone will reach out to you at our earliest availability!