You have important decisions to make when you become eligible for Medicare. Our goal is to help you understand your options and feel confident about choosing coverage based on your needs, when you first enroll, and every year after that. We’re here to help!

Getting Started with Medicare can feel like a daunting task if you don’t know where to start, or how it works. In this post we will cover the basic necessary information so you can make educated choices regarding your future in Medicare health care.

Who can get Medicare?

U.S. Citizens and Legal Residents: Legal residents must live in the United States for at least 5 years in a row, including the 5 years just before applying for Medicare.

You must also meet one of the following requirements:

- Age 65 or older

- Younger than 65 with a qualifying disability.

- Any age with a diagnosis of ESRD (End Stage Renal Disease) or ALS.

How do you enroll?

You should be automatically enrolled if you are receiving Social Security or Railroad Retirement Board benefits when you become eligible. You’ll receive your Medicare card in the mail. If you are not receiving benefits, you will need to sign up for Medicare when you become eligible. You can contact your local Broker (Group Plans Inc) or go to SSA.gov/Medicare to enroll online, or call or visit you local Social Security office.

What are the coverage choices?

Original Medicare (Parts A & B) is provided by the federal government. It helps pay for hospital stays and doctor visits, but it doesn’t cover everything. You may add coverage by enrolling in one or more private Medicare or Medicare-related plans.

Medicare Supplement Insurance Plans: (Medigap) help pay some of the ou-of-pocket costs that come with Original Medicare.

Medicare Prescription Drug Plans: (Part D) help you pay for prescription medications. Original Medicare does not cover prescription drugs.

Medicare Advantage Plans: (Part C) offer an alternative to Original Medicare. Plans combine Part A and Part B coverage into one plan. They often include prescription drug coverage, too. Some plans offer additional benefits like coverage for routine vision and dental care.

- Step 1: Enroll in Original Medicare. Part A and Part B. Part A helps pay for hospital stays and inpatient care, while Part B helps pay for doctor visits and outpatient care.

- Step 2: Decide if you need additional coverage. Option 1 would be to add one or both of the following to Original Medicare; Med Sup/Medigap, which helps pay some out-of-pocket costs that come with Original Medicare, and Part D which helps pay for prescription medications OR choose a Medicare Advantage plan; being Part C which combines your Part A and B into one plan and usually includes a Part D, which helps pay for prescription meds, and may offer additional benefits not provided by Original Medicare.

QUICK TIPS

There are two ways to get Medicare Coverage.

- You can choose Original Medicare (Parts A and B). Part A is hospital coverage and Part B is medical coverage. Original Medicare is provided by the federal government. Benefits and coverage are the same across the country.

- Or you can join a Medicare Advantage plan (Part C). Medicare Advantage plans combine Part A & Part B coverage. Many also include prescription coverage (Part D) and offer additional benefits. Plans are offered by private insurance companies.

You will pay a share of your costs.

- Neither Original Medicare nor a Medicare Advantage plan will pay for everything.

- You are responsible for monthly premiums as well as out of pocket costs, such as deductibles, copays and coinsurance.

Protection from high out-of-pocket costs is available

- Medicare Advantage plans put a cap on your out-of-pocket costs for covered medical services. It’s called the “annual out-of-pocket maximum” and it provides built-in financial protection. There is no out-of-pocket cap with Original Medicare.

- Medicare Supplement insurance plans help pay some out-of-pocket costs not paid by Original Medicare, like deductibles and coinsurance. Plans are sold by private insurance companies.

- You don’t need and can’t use a Medicare supplement insurance plan if you have a Medicare Advantage plan.

There are two ways to get drug coverage.

- You may add a standalone prescription drug plan (Part D) to Original Medicare.

- Or you may enroll in a Medicare Advantage plan that includes prescription drug coverage.

- Plans are offered by private insurance companies.

You may have many options

- Medicare Advantage plans and prescription drug plans vary in terms of coverage and cost. Insurance companies may offer several plans where you live.

- Medicare supplement insurance plans are standardized and are the same nationwide, except in Minnesota, Wisconsin, and Massachusetts.

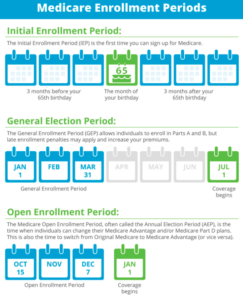

Timing matters when you first enroll

- Your Initial Enrollment Period (IEP) is your first chance to enroll in Medicare and choose the coverage you want. Your IEP is 7 months long. It includes you birthday month or the 25th month of getting disability benefits plus the 3 months before and 3 months after.

- You are automatically enrolled in Part A and Part B if you are receiving Social Security or Railroad Retirement Board benefits when you become eligible for Medicare. Otherwise, you must enroll yourself.

- Medicare Part A, Part B, and Part D may charge penalties if you sign up after your IEP ends, unless you qualify for a Special Enrollment Period (SEP).

It’s wise to review your choices every year

- Medicare Open Enrollment happens each year from October 15th to December 7th. You may change your coverage choices during this time if you decide to.

- You may switch from one Medicare plan to another. You may also switch from one Medicare Advantage plan or prescription drug plan to another. You may also switch from Original Medicare to a Medicare Advantage plan, or vice versa.

- Changes go into effect on January 1st.

You may enroll or make changes at other times

- Medicare provides Special Enrollment Periods for Qualifying life events. Examples include moving your primary residence or leaving an employer health plan.

- Visit Medicare.gov for a complete list of qualifying events.

Understanding Your Needs

Look for coverage that works for you. Consider these questions to help determine what kind of coverage may be right for you.

Frequent doctor visits can get costly. How often do you visit the doctor, in general?

- With Original Medicare (Parts A & B), you pay 20% of the allowed amount for most doctor services after you meet the Part B deductible. Most Medicare supplement plans pay this cost in full.

- With most Medicare Advantage Plans, you pay a low copayment for each visit. Your plan may or may not have a deductible.

- Medicare Advantage plans have an annual out-of-pocket limit that offers financial protection. There is no limit with Original Medicare.

Are the medications you take regularly covered?

- Most prescription drug plans and Medicare Advantage plans that include drug coverage have a list of covered drugs, or formulary.

- If your drugs are not on the formulary, you may have to pay more.

Do you have a particular doctor, hospital or pharmacy that you want to use?

- Many Medicare Advantage plans contract with a network of providers and pharmacies.

- You may pay more if your provider or pharmacy is not in the network.

- Original Medicare and most Medicare supplement plans provide coverage nationwide.

Does your doctor accept Medicare assignment?

- Doctors who accept assignment agree to the Medicare-approved amount as payment in full.

- Doctors who do not accept assignment may charge more than the Medicare approved amount for some services.

- The traditional cost is called “excess charges”.

- Some Medicare supplement plans pay excess charges.

Do you have other health coverage, such as through an employer, a union, or the military?

- Medicare may work with your other health coverage.

- Talk to your plan administrator before you make any decisions.

Would you rather pay less in monthly premiums or pay less out-of-pocket when you receive health care?

- In general, when premiums go up, out-of-pocket costs like deductibles, copays and coinsurance go down.

- The opposite is also true. Low monthly premiums could mean high out-of-pocket costs go up.

- Look at all the costs – not just premium – when comparing coverage options.

If you or someone you know would like more assistance enrolling in or understanding their Medicare benefits, please reach out to us by filling out the brief contact form below or by calling us direct at (623)-889-7600!