Difference Between Group Health & Individual Health Insurance Plans

As the owner of a small business, offering your employees a comprehensive insurance benefits package might be in your best interest, but how do you know what will work and what won’t work? Health Insurance is a great place to start but there are a lot of options available. For example, what is the difference between individual health insurance plans and group business health insurance plans for your employees?

Take a few moments and learn more about what each of these mean and how they could work or benefit you.

What is Group Health Insurance?

To put it simply, Group Health Insurance is a health insurance plan an employer extend to their employees or their business’ staff and potentially to their dependents as well. With a group health insurance program, small business owners pay either part, or all of the cost of the monthly premiums for their employees, but typically may reap certain tax benefits as a result.

What is Individual Health Insurance?

Individual Health Insurance is a type of health policy an individual would purchase for him or herself, and/or their family. Individual health insurance policies are often purchased with the guidance of an experienced insurance agent or broker to help them navigate the various choices, plans and premium costs. Insurance companies may no longer deny or charge more based on medical conditions and premium tax credits are available to those who qualify for them.

When buying their own individual plans, employees may have more control over what plan to choose, but they likely end up paying more, either in monthly premiums or out-of-pocket costs.

What are the differences between Group and Individual Health Insurance?

There are a quite a few differences between these two forms of health insurance, for the employer, staff, or individual.

- Group Health Insurance coverage for an employee usually starts shortly after you hire a new employee. This is usually a major consideration to look at, because new hires will know when they will have coverage.

- Individual Health Insurance plans require a little more planning. A new employee must generally shop for a plan and purchase during the nationwide ACA open enrollment period or after experiencing a qualifying life event.

- With Group Insurance, you may provide your employees with quality health insurance benefits they may not be able to afford themselves.

- With individual coverage, you are leaving your employees to get coverage for themselves in compliance with the ACA. There may be ways you can legally help them cover the cost of their coverage in some states, but the rules are restrictive, and you’ll need to work with legal and tax advisors to make sure you’re in compliance.

- Group Health Insurance plans tend to be a better investment for a small business. As an employer, you will likely pay at least 50% of the monthly premiums for your employees, but you can typically deduct these costs from your business taxes and, in some cases, you may even be eligible for special small business health insurance tax credits/ Any contribution your employee makes toward their premiums are generally paid from their pre-tax salaries, which can ultimately lead to more savings for them as well.

- With Individual Insurance plans, the payments made by your employees are typically not from their pre-tax salaries, so they would typically have to pay more of their total compensation in taxes. Depending on their level of income, however, they may be eligible for special government subsidies under the ACA.

There is no real right or wrong answer when it comes to Health Insurance planning for small businesses because there are just too many variables to consider. A licensed broker can help you develop a strategy and list the pros and cons that help you decide what’s best for your company and your employees. Always consult your tax and legal advisors to understand your specific tax and compliance situation.

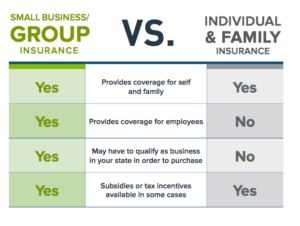

Here are some of the main characteristics of Group Health Insurance and Individual Health Insurance.

Group Individual

Protection when job is lost (Employee) Limited Yes

Protection when changing jobs (Employee) Limited Yes

Choice of medical providers (Employee) Limited Yes

Coverage of pre-existing conditions (Employee) Yes Yes

Who purchases the plan? Employer Employee

Tax Deductible? Yes Sometimes

The average national annual costs of premiums for health insurance with a group, or an individual are as follows:

Single Coverage

Group Health Insurance Plan 2018. $6,896/Year

Individual Health Insurance Plan 2018 $7,452/Year