If you’re one of the 2.9 million students who have already or are about to embark on their journey as freshmen in college nationwide, please consider this! As you navigate the due processes before starting school, such as purchasing books, moving in to your dorm, meeting your roommate, or just discovering the area and places to eat, don’t forget about to think about your Health Insurance.

Whether you are new to college or a graduate student, the options and choices you have will depend on a few things, like where you go to college, if you already have coverage through a family or through and individual plan, and how much money you make.

It may come as a surprise to find out that you could qualify for No-Cost Medicaid, which is the public Health Insurance program designed for people who have low income.

If you’re not sure where to start, and since health care plans vary from state to state, the first step should be to an Insurance Agent or Insurance Broker in the area your college is located to have a consult and discuss your options. The assistance is free, as the services that an Insurance Agent or Broker receives their payment through the insurer, not from you directly, so whether you move forward or not, the services and the assistance in navigating your insurance plan choices are free.

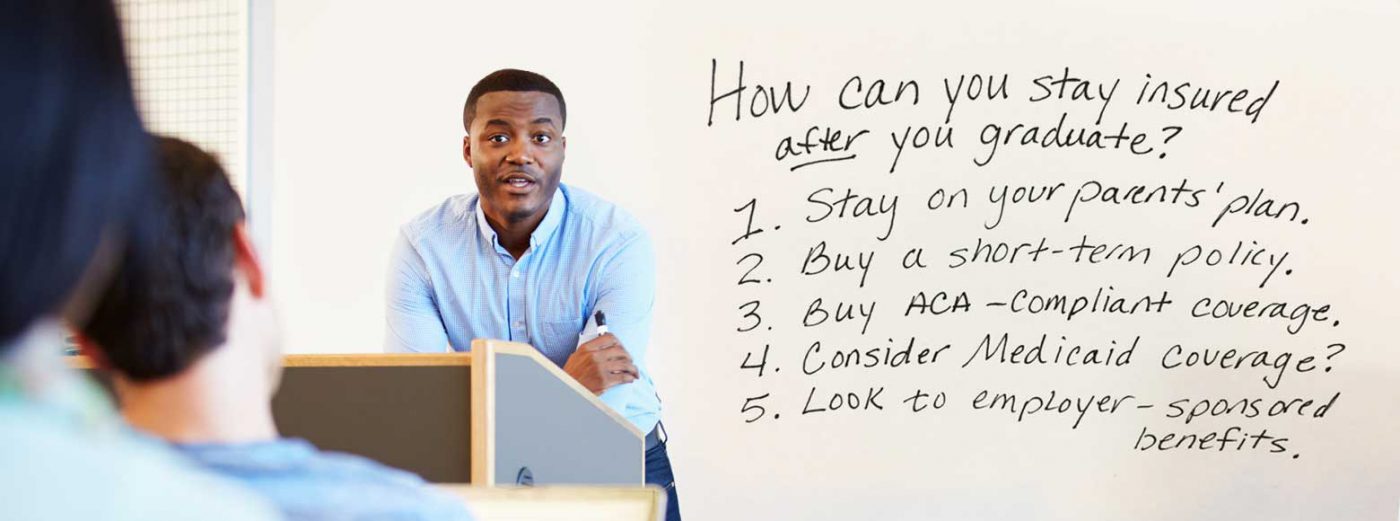

Many times, children who are on their family’s plan choose to stay on their plan, which can be done up until the age of 26. If you are already on your family’s plan, it is still recommended to call the customer service number on your insurance card to ask about the level of coverage, if any at all, that it will provide if you attend college out of state. For example, if your family health care plan is a Preferred Provider Organization (PPO) with a national insurance company like Cigna, Aetna, or UnitedHealthcare, often times you can still receive full medical services at in-network prices in other regions of the country.

However, financially, it still has to work. Parents can ask their employer or their insurer if taking their child off of the family PPO will lower their premium. If the answer is no, and they will have full network coverage while at college, it makes perfect sense to just keep them on the plan. If the answer is, yes, it will lower your premium, it’s time to do the math. One real life example of this would be that of a CEO who learned he would save $1,900 this year by taking his son off of the family’s Blue Cross Blue Shield PPO plan and buying him the student plan offered by Purdue University where he is a freshman. Ask about programs like this where your child will be attending college.

It makes sense to take your student off of the family plan if it is a HMO, or Health Maintenance Organization, or exclusive provider organization, both of which restrict their networks more than a PPO does.

Of course, there are always exceptions to the rule. Some insurers allow HMO enrollees to get full medical care at no extra cost in other regions or states where they operate. Ask your insurer if that’s possible. If it isn’t, then the health care plan offered by the college may be a good option to consider.

Healthcare Insurance plans for students have improved over the last few years, partly because they almost always comply with the ACA coverage requirements. That means that most offer a comprehensive range of medical services at a high level of coverage, sometimes even coming with vision and dental coverages depending on the college and the region. Another thing to consider and be diligent about is that some colleges automatically enroll you in their health plan, and you need to obtain a waiver, proving you have other acceptable coverage, to avoid the cost charges. Make sure you’re not being opted into services you won’t use.

If the family plan doesn’t work for you and your college plan is too expensive, check to see if you qualify for No Cost Medicaid. In more than 30 states Medicaid has expanded. It helps if your parents do not claim you as a dependent on their tax returns, otherwise, you must report their income. If your income is still too high for Medicaid, you still might qualify for a subsidy to buy a health plan through your state’s ACA.

It is really important to be prepared, or to help your college aged student be prepared by making sure they are covered should they need medical attention, especially if the college is outside the region and will likely have to go through those processes alone once school starts. It is always better to plan ahead to make sure your child or student doesn’t have to worry about seeking medical care or worry about the costs. It’s also important to go over the details of the Health Insurance plan they obtain so they are clear of their benefits and how to use them!!

If you have any questions regarding your Health Care Coverage, or that of your student, please give us a call and we can provide you with guidance and information, as well as an arrangement of plan options so that you can be confident sending your student to school knowing they will be covered!