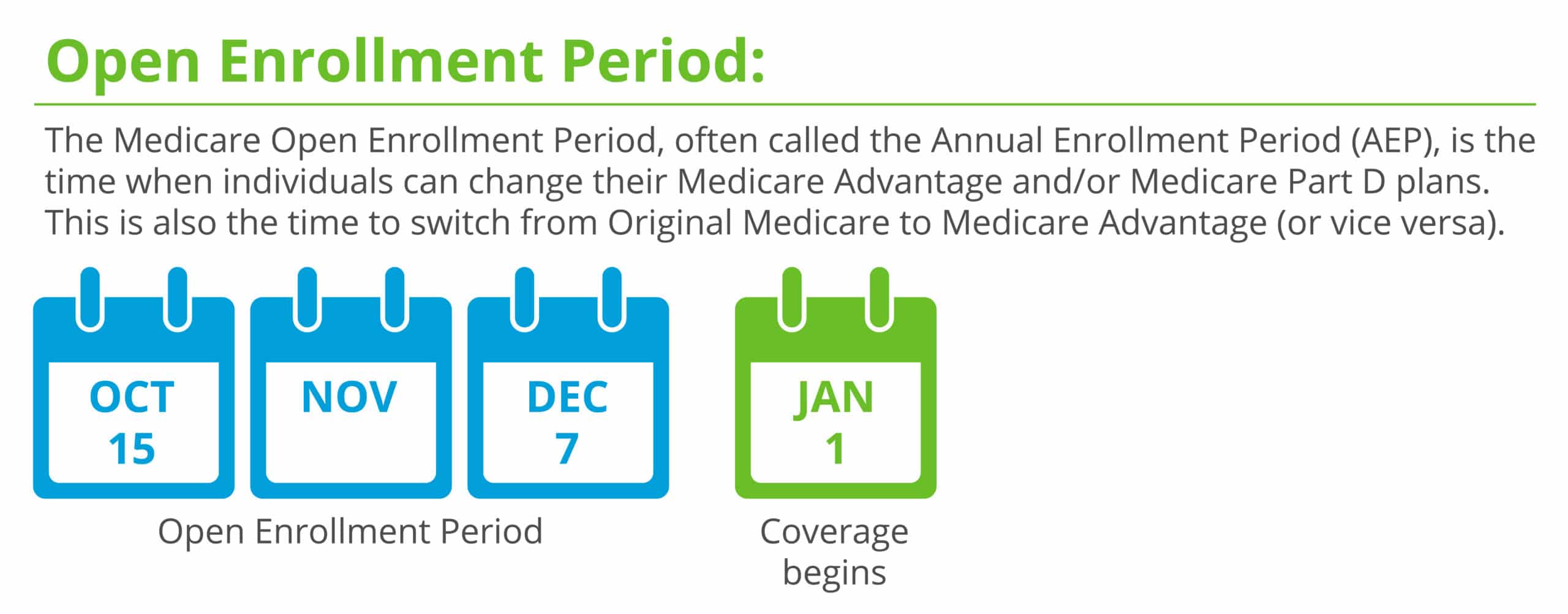

It’s that time of year again! The Medicare Annual Open Enrollment has officially begun as of October 15th, and will continue through December 7th. This is the time to make any changes to your Medicare health and drug coverage that will take effect on January 1, 2022.

There are other important enrollment dates to remember, like the Medicare Advantage Open Enrollment, as well as how Special Enrollment works. You will find more information on those in this article!

It is very important to make sure you are making the necessary changes or updates to your Medicare plan within the time frame given, so you don’t run into any deadline issues or lapses in any kind of coverage. Below we will go over the different enrollment periods for Medicare and the qualifications for each.

What changes can you make during Medicare Open Enrollment?

During Medicare Open Enrollment, which is October 15th through December 7th, you can review your existing coverage and make changes to your plans if you’d like to. These changes will begin to take effect on January 1st, 2022. During the Open Enrollment, you can switch from:

- Original Medicare to a Medicare Advantage plan

- A Medicare Advantage plan to original Medicare

- One Medicare Advantage plan to another

- One Medicare Part D drug plan to another

- You can also join a Part D drug plan or drop your Part D coverage.

There are other enrollment periods for Medicare, so we will differentiate those for you.

- Initial Enrollment Period

- General Enrollment Period

- Annual Enrollment Period

- Medicare Advantage Enrollment

- Special Enrollment Period

We covered the Annual Enrollment Period for Medicare above (October 15th through December 7th). Below you will find out more information on the remaining enrollment periods that are relevant to Medicare and how you can utilize each enrollment period.

Medicare Initial Enrollment Period

The Initial Enrollment Period, or IEP, is when you first become eligible for Medicare coverage. You get a seven-month window to enroll around your 65th birthday. Three months before your birthday month, your birthday month, and 3 months after your birthday month. During this time, you can sign up for Original Medicare, also known as Part A and Part B coverage.

Medicare General Enrollment Period

The General Enrollment Period is for people who didn’t sign up for Medicare Parts A or B during their Initial Enrollment Period or those who aren’t eligible for a special enrollment period. This runs from January 1st through March 31st. If you forgot to sign up when you were first eligible, this is your chance to enroll on the coverage you’re entitled to. Those eligible for Medicare that delay their enrollment for one reason or another will need to sign up during this period.

The General Enrollment Period for Medicare takes place from January 1 through March 31 of every year. When you enroll during this time, your coverage begins on July 1. It’s likely since you delayed enrollment that you’ll pay a Part B late enrollment penalty.

Medicare Advantage Plan Enrollment

Each year, there’s also a Medicare Advantage Open Enrollment Period from January 1 – March 31. During this time, if you’re in a Medicare Advantage Plan and want to change your health plan, you can switch to a different Medicare Advantage Plan with or without drug coverage.

If you have a Medicare Advantage Prescription Drug Plan, you can switch to another or you could switch to just a Part D plan.

You can only make one change to your healthcare coverage during this time, so choose wisely. Once you make that change, you cannot make another change until the Medicare Annual Enrollment Period (October 15th – December 7th) outside of qualifying for a Special Enrollment Period.

This enrollment period is ONLY for beneficiaries currently enrolled in a Medicare Advantage plan.

Medicare Special Enrollment Period

People who already have Medicare may qualify for a 2-month Special Enrollment Period (SEP) with certain life qualifying events. This SEP lets you switch to a different Medicare Advantage or Part D prescription drug plan.

You may qualify for a 2-month Special Enrollment Period in the following situations:

- You move out of your plan’s service area

- Your plan closes, stops serving the area where you live, significantly reduces its provider network or your plan consistently receives low Medicare Star Ratings.

- You want to enroll in a 5-star plan at any time or drop your FIRST Medicare Advantage plan within 12 months of enrolling.

- You move into or out of a qualified institutional facility, like a nursing home.

- You are enrolled in or lose eligibility for a qualified State Pharmaceutical Assistance Program.

- You have Medicare financial assistance such as Medicaid, a Medicare Savings Program, or Extra Help or you gain or lose eligibility for any of these.

- You enroll in or leave the Program of All-Inclusive Care for Elderly (PACE).

- You gain or lose eligibility for a Special Needs Plan.

Some situations not listed here may qualify for a Special Enrollment Period as well. If you have questions about your personal situation, call your State Health Insurance Assistance Program for help.

When Working Past 65: 8 Month Special Enrollment

For people who work past 65 and qualify to delay Medicare with creditable employer coverage, there is an 8-month Special Enrollment Period that allows you to enroll in Part A (if you haven’t yet), Part B, Part C, and Part D without late penalties.

This Special Enrollment Period is tricky though. Why? Because while you have the whole 8 months to get Parts A & B, you only get the first 2 months to enroll in Part C or Part D without penalty. If you enroll after the two-month mark, you’ll face late enrollment penalties for Part D (regardless of whether you end up with a stand-alone Part D plan or a Medicare Advantage plan that includes drug coverage).

To qualify for the Part B Special Enrollment Period, you must have a creditable employer or union health coverage based on current employment. Your Special Enrollment Period will begin eight months after your employer coverage ends or you leave your job, whichever happens first.

It is always wise and even recommended to review your Medicare plans during the Open Enrollment in the Fall each year, as the plans available can change from year to year. A review will ensure you are on the best plans to suit your specific needs and allow you to take advantage of any new information available regarding changes in plans, new benefits being offered, or any discontinuing plans.

Review Your Plans Each Year

Group Plans Inc can assist you with a free and fully comprehensive plan review of all your Medicare plans and offer any assistance on enrollment, switching plans, or providing information and guidance to the plans the best suit your needs. Call us now and set an appointment for a free plan review!

(623) 889-7600