If you are eligible for Medicare, you may find that navigating the complexities of Medicare can be pretty tricky. Now that the Enrollment Period has ended for 2020 coverage you may have enrolled in a Medicare Part D plan. If you are almost Medicare age, just before and after your 65th birthday you will have a Special Enrollment period in which you can choose to enroll in Medicare, including a Part D plan. When deciding the best plan for you, it’s important to look for what you need and want from your healthcare, whether that’s focused on preventative care or a plan that ensures your current medication regimen is continued.

Prescription Coverage

If you require access to consistent prescription medication, you’ll need a plan that covers prescriptions. That’s where Medicare Part D plans come in. Part D plans offer prescription drug coverage to help ease the out-of-pocket costs of prescription medication.

Individuals covered under Medicare Part A and/or Part B plans are eligible for Part D plans regardless of income. Each Part D plan covers different drugs, so it’s really important that yo are signing up for a plan that covers the medication you need.

Part D Plans

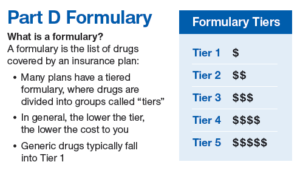

So what do Medicare Part D plans look like? Most plans will typically have a monthly premium that varies from plan to plan, an annual deductible, and a co-pay. Co-pays are generally determined based on what “tier” the particular prescriptions fall under.

Most plans have tiers broken into Tier 1: lowest co-pay for generics, Tier 2: medium copay for preferred brand-name drugs, and Tier 3: higher co-pay for non-preferred, brand-name drugs and the Specialty Tier: highest co-pay for very high-cost drugs. You pay a monthly premium to an insurance carrier for your Part D plan and in return, you use the insurance carrier’s network of pharmacies to purchase your prescription medications. Instead of paying full price, you will pay a co-pay or a percentage of the drug’s cost, and the insurance company will pay the rest.

Often, the same medication will vary in price based on what Part D Plan you sign up for. Be sure to compare the plans you qualify for closely to determine which plan would work best to suit your specific needs and your specific budget. The Annual Enrollment Period for Medicare Part D plans is from October 15th to December 7th, unless you qualify for a Special Enrollment Period, meaning you’ve had some major life events happen, such as getting married, adopting a child, or losing your employer based insurance after you lose your job.

There are 4 stages to a Part D drug plan, as follows:

- Annual Deductible – in 2020, the allowable Medicare Part D deductible is $435. Plans may charge the full Part D deductible, a partial deductible, or waive the deductible entirely. You will pay the network discounted price for your medications until your plan tallies that you have satisfied the deductible. After that, you enter initial coverage.

- Initial Coverage – during this stage of Part D drug coverage, you will pay a copay for your medications based on the drug formulary. Each drug plan will separate its medications into tiers. Each tiers has a copy amount that you will pay. For example, a plan might assign a $7 copay for a Tier 1 generic medication. Maybe a Tier 3 is a preferred brand name for a $40 copay, and so on. The insurance company tracks the spending by both you and the insurance company until you have together spent a total of $4020 in 2020.

- The Coverage Gap – after you’ve reached the initial coverage limit for the year, you enter the coverage gap. During the gap, you will pay only 25% of the retail cost of your medications. (This is so much better than in 2006 when many people had to pay 100% of their drugs in the gap.) Your gap spending will continue until your total out of pocket drug costs have reached $6350 in 2020. Please note that to get into the gap, Medicare tracks the total costs of what you and the insurance company have spent, but to get OUT of the gap, they are counting only what you have paid in deductibles, copays and gap spending that year, plus manufacturer discounts. They do not count anything the federal government contributes.

- Catastrophic Coverage – after you’ve reached the end of the coverage gap, your plan will kick in to pay 95% of the costs of your formulary medications for the rest of the year. This feature in Part D drug plans helps you limit your potential spending if you have expensive medications.

Drug utilization rules that affect your Part D coverage

Medicare allows drug plan carriers to apply certain rules for safety reasons and also for cost containment. The most common utilization rules that you may run into are:

- Quantity Limits – a restriction on how much medication you can purchase at one time or upon each refill. If your doctor prescribes more than the quantity limit, then the insurance company will need him to file an exception form to explain why more is needed.

- Prior Authorization – a requirement that you or your doctor must obtain plan approval before allowing a pharmacy to dispense your medication. The insurance company may ask for proof that the prescription is medically necessary before they allow it. This usually affects medications that are expensive or very potent. The doctor must show why this specific medication is necessary for you and why alternative drugs might be harmful or ineffective.

- Step Therapy – the plan requires you to try less expensive alternative medications that treat the same condition before they will consider covering the prescribed medication. If the alternative medication works, both you and the insurance company save money. If it doesn’t, your doctor to help you file a drug exception with your carrier to request coverage for the original medication prescribed. He will explain need to explain why you need the more expensive medication when less expensive alternatives are available. Often this requires that he show you have already tried less expensive alternatives that were not effective.

Restrictions are Part of All Part D Drug Plans

ALL of these 3 types of restrictions occur throughout the formularies of every Part D drug plan in the market. They are especially common with pain medications, narcotics and opiates. If you take a significant amount of pain medication, be prepared that you will deal with his extra paperwork on regular basis no matter which drug plan you choose.

People often think that changing from one drug plan to another will help. However, nearly all Part D carriers have restrictions on pain meds. You will encounter this no matter which plan you are on. The best you can do is to pick a carrier with the lowest overall annual anticipated spending. Then file the required exception forms to try to get as much approved as the plan will allow.

There are also some medications which are not covered by Part D. If you take a medication that is not on the formulary, such as a compound medication, you will have to file an exception to try to get that drug approved. Not all exceptions are approved, so be aware that you may pay out of pocket for any medication that is not covered by your plan or by Part D as a whole.

Part D drug plans are among the most confusing Medicare topics. All too often people join a plan without checking to make sure the formulary includes their medications. Sometimes they also miss that one of their medications has step therapy rules applied. Many beneficiaries also miss their initial enrollment window, so if you need drug coverage, be sure not to miss your window!

We always recommend to seek out the expert guidance of a professional, licensed and experienced Health Insurance Broker that specializes in Medicare, like Group Plans Inc. The services provided help you understand the plans available, as well as help you choose the best plan specifically for your needs. We can also help you with cost comparisons, how to file claims, how and where to use your insurance and to help you check if your drugs or preferred networks have changed and to make sure you are happy and educated about the plans you choose.