Health Reimbursement Arrangements or HRA’s have been around for a couple of decades, but they have gained a lot of momentum over the past several years as more and more employers are looking for alternative options to expensive “one-size-fits-all” group insurance plans. There are a few different HRA types, and here we will explain the basics!

What is an HRA?

An HRA is an arrangement between employers and their employees to reimburse for medical expenses and/or insurance premiums tax-free. HRA’s are built on a series of regulations to make sure they are being offered fairly and are achieving their intended aim of making health insurance more accessible and affordable for employers and employees.

An HRA is NOT…

- An account that requires pre-funding

- “Use it or lose it” like an FSA (given that it isn’t pre-funded)

- An investment account that gains interest, like an HSA.

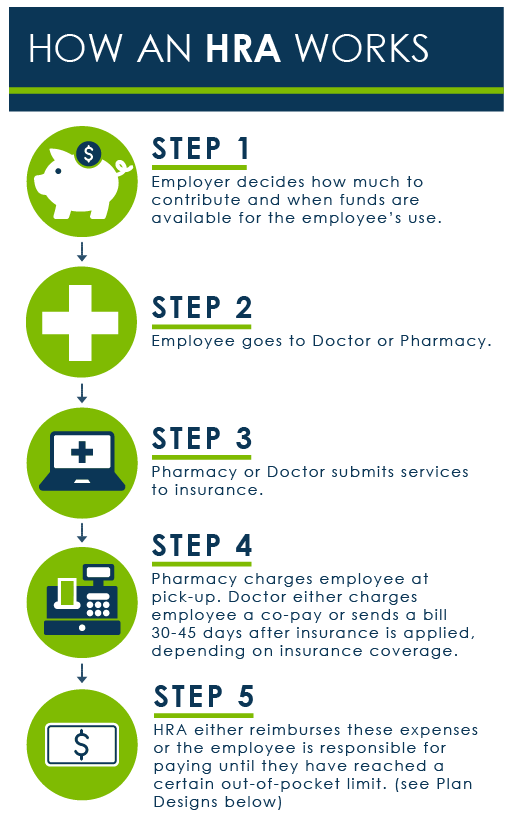

How it actually works is pretty simple: The employer chooses an HRA for her or his company, sets a budget that works for them, and then lets the employees know they can use it. From there, once an employee pays for a medical expense or premium, they just turn in the receipt and submit for reimbursement.

The employer “owns” the HRA but the employee “owns” their individual insurance plan, making it portable for continuous coverage should they change jobs.

HRA Types

The regulations that have historically (and still even..) govern traditional HRAs come from Tax Code Section 105. So, because of this, you will hear tax geeks and insurance brokers refer to “Section 105 HRAs”. You may also hear people speak about Integrated HRAs and Standalone HRA’s.

The Difference Between Integrated and Standalone HRAs:

Integrated HRA’s are “integrated” with a traditional group health insurance plan and used to help reimburse out-of-pocket medical expenses not paid for by the group health plan. Typical examples would be co-pays, co-insurance, deductible payments, etc.

ICHRA – Available as of January 1, 2020, the individual coverage health reimbursement arrangement allows for tax-free reimbursement of benefits for any size business and for any amount.

EBHRA – Excepted Benefit HRA’s are limited to paying for excepted benefits, like premiums for vision and dental coverage or similar benefits from ACA and other legal requirements. These HRA’s are only permitted if employees are offered coverage under a group health plan sponsored by the employer. Along with ICHRA, these two HRA types are the new kids on the block (and we think they are going to change the employer-sponsored benefits market in a big way!).

Standalone HRAs are not required to be tied to a group plan. They have a complicated history and can be even more complicated to implement based on tangled federal and state insurance regulations. A few common types that still longer around are:

Qualified Small Employer HRA – For businesses with less than 50 employees that do not offer a group plan, business owners can set up a QSEHRA for their team to help pay for benefits tax-free. Unlike the other standalone HRAs in this list, this small business HRA was created by the 21st Century Cures Act book in 2017 and signed into law by President Obama.

Spousal HRA – For employees covered by a spouse’s insurance plan, a spousal HRA could reimburse medical expenses but not premiums.

Retiree HRA – For former employees of a firm, an employer could use a retiree HRA to help pay for retired members’ insurance premiums and medical expenses.

Medicare HRA – For employers with less than 19 employees, employers could elect to reimburse a portion of an employee’s Medicare supplement premiums.

Benefits of an HRA

- Transfers employer responsibility for health risks. If you would rather not try to manage the risk of employee healthcare, know that you can still offer generous benefits wit an HRA and your costs are fixed because you have no risk to manage. Since you are offering a fixed amount per month, there’s no need to spend time and mental energy trying to implement wellness programs and manage your employee’s healthcare spend to control your costs on a traditional group health plan. This makes cost predictable year over year, as opposed to group plan premiums.

- Personalized Plan Choices for Employees. No employee is locked into a plan that might not be a good fit for them. They can also take their plan with. them if they leave.

- Flexible Plan Design. The newer flavors of HRAs have built-in design capabilities to custom tailor an HRA to a business’s needs. An ICHRA, for example, has eleven classes available for scaling benefits. With QSHERA, employers have to treat full-time employees fairly, but there are a lot of levers they can pull on how much to reimburse and who gets to participate.

- Greater Budget Control. The employer sets the allowable reimbursement rates and costs will never be greater than that. If employees don’t buy insurance or don’t use all of their allowances? The employer keeps the money.

- No Participation Concerns. If employees decide not to use the benefit, there is no cost or concern for the plan.