Happy Birthday! By 26, you’ve got quite a few life milestones and some useable experience under your belt. Now here’s another one: Shopping for health insurance.

Under the ACA (Affordable Care Act), young adults can stay on their parents’ health insurance plans until they turn 26 – even if they are married, have children of their own, or live in a different state.

However, once you hit age 26, you may need to make decisions about how to stay insured. Chances are, you’re a first-time health insurance shopper. Here’s what you need to know about your options for Health Insurance and healthcare coverage after you turn 26 years old.

What Happens at 26?

For the most part, 26 is the age when you are required to buy your own health insurance, but there are exceptions. New York State for example, allows people who are under 30 and unmarried to stay on their parents’ health insurance plans. New Jersey lets unmarried and childless residents do the same until age 31. In Arizona, after 26, you are required to get your own Health Insurance Plan.

Your parents’ plan may allow you to keep your coverage until the end of the month that you turn 26, or perhaps until the end of the calendar year, depending on the plan specifics. Others remove you the day you turn 26 years old. As your birthday approaches, make sure to understand when your parents’ plan ends for you.

Normally, you can only apply for Health Insurance coverage during a window of time known as Open Enrollment, which occurs between November and December each year. However, young adults who age out of their parents’ health care insurance are eligible for a Special Enrollment Period of 120 days – the 60 days before you turn 26 and the 60 days after – to buy their own health insurance.

If you miss this window, you may have to wait for the regular Open Enrollment Period in the fall and risk a gap in coverage.

What Are Your Options?

Cobra: You may be able to remain on your parents’ insurance plan for up to 36 months after turning 26 through the Consolidated Omnibus Budget Reconciliation Act, more commonly referred to as COBRA (provided your parents work for a company that has more than 20 employees). You will have to submit a written form to ask for coverage to continue and you’ll have to pay for it separately.

Your Employer: Talk to your own employer’s Human Resources department about what health insurance options are available to you as an employee and when you need to submit paperwork.

Your Spouse: If you are married, look into signing up for you spouse’s employer-sponsored health insurance plan.

Student Health Plan: Students enrolled in colleges and universities that offer a student health plan can enroll in health insurance plans through their schools.

Health Insurance Marketplace: If you’re self-employed, or don’t have coverage through your employer or your spouse’s, you can get coverage through the Health Insurance Marketplace (the exchange).

Here’s How the Exchange Works

You can start your search at healthcare.gov, which can help you figure out which type of plan you are eligible for and how much you can expect to pay. You may qualify for a federal tax credit depending on your income (as long as no one else claims you as a dependent). You can also contact a local insurance broker. They are able to assist you without any type of service fee, as they are paid by the marketplace for assisting you. An experienced and licensed broker can make the whole process really simple and help you understand anything you may not fully comprehend, as well as help throughout the year as needed.

Individuals living in states that expanded Medicaid and whose modified adjusted gross income (MAGI) is between 100 and 400% of the federal poverty level can get a tax credit – effectively a subsidy for their premium.

You can get help sorting through your options by contacting a broker (or the marketplace) to help you enroll in a marketplace plan, but bear in mind that the tax credit is only available when you enroll in a Marketplace plan.

Know Your “METALS”

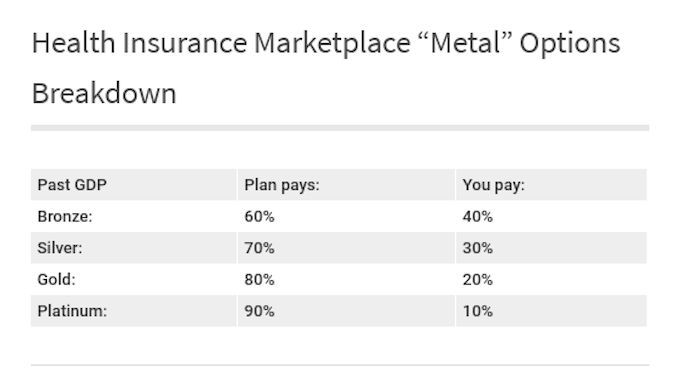

When you buy Health Insurance on the Health Insurance Marketplace, you’ll have the option to purchase different levels of coverage, which go by four “metal” categories: Bronze, Silver, Gold, and Platinum.

Bronze and Silver plans have lower premiums – but lower levels of coverage than Gold and Platinum plans.

The different plans split the cost of health care this way:

If you are 26, or turning 26 and would like to receive some assistance in obtaining coverage, please contact us: Group Plans Inc at (623)-889-7600 or fill out the contact form below!

We know how stressful it can be navigating the insurance market maze alone, especially as a first time Health Insurance buyer. We would love to assist you in a fully comprehensive service that helps you find coverage, compare plans, understand your benefits, and helps you all along the way!